Financial Advisor vs Financial Planner: Understanding the Distinctions

Are you confused about what differentiates a financial advisor from a financial planner? You’re not alone. Many people mistakenly use these terms interchangeably, but they actually refer to two distinct roles in the financial services industry. Understanding the differences between a financial advisor and a financial planner can help you make informed decisions about your financial goals.

Roles and Responsibilities of a Financial Advisor

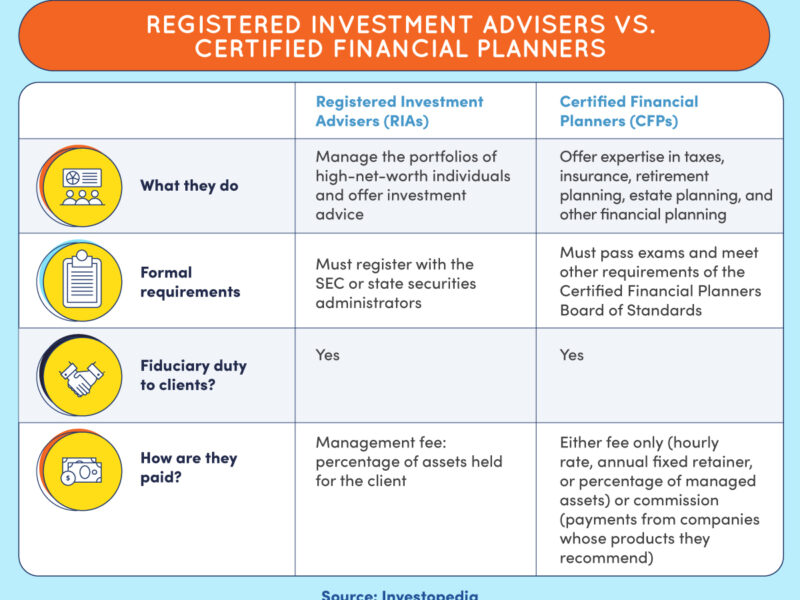

A financial advisor typically provides investment advice and helps clients manage their investment portfolios. They analyze market trends, recommend investment strategies, and offer guidance on specific investment products. Financial advisors are experts in the finance industry, and they stay up-to-date with the latest market trends and investment opportunities. They assess your risk tolerance and financial goals to develop an investment plan tailored to your needs. Additionally, financial advisors may also provide guidance on tax planning and asset protection.

Financial advisors offer a range of services, including retirement planning, college savings plans, and insurance recommendations. They work closely with their clients to understand their financial objectives and develop strategies to achieve them. Whether you’re an individual looking to grow your wealth or a business owner seeking to maximize your investments, a financial advisor can provide valuable insights and recommendations to help you reach your financial goals.

Roles and Responsibilities of a Financial Planner

On the other hand, a financial planner takes a holistic approach to your financial well-being. They consider your entire financial picture, including your goals, income, expenses, and risk tolerance, to create a comprehensive financial plan. This plan may include investment advice, tax planning, retirement planning, estate planning, and more. Financial planners work closely with their clients to understand their unique circumstances and develop a roadmap for their financial future.

Financial planners focus not only on investments but also on the broader aspects of financial planning. They help clients set realistic financial goals, create budgets, manage debt, and develop strategies for long-term financial success. In addition, financial planners provide guidance on insurance coverage, estate planning, and other important aspects of wealth management. Their objective is to ensure that their clients have a well-rounded financial plan that aligns with their goals and values.

Education and Credentials Required for Each Role

To become a financial advisor, individuals typically need a bachelor’s degree in finance, economics, or a related field. Some financial advisors also pursue advanced degrees, such as a Master of Business Administration (MBA) or a Certified Financial Planner (CFP) designation. In addition to education, financial advisors may need to obtain relevant licenses and certifications, such as the Series 7 and Series 66 licenses, which allow them to sell securities and provide investment advice.

Financial planners, on the other hand, often hold the Certified Financial Planner (CFP) designation, which requires additional education, experience, and passing a comprehensive exam. A CFP designation signifies that the financial planner has the knowledge and skills necessary to provide comprehensive financial planning advice. Financial planners may also have additional certifications, such as the Chartered Financial Consultant (ChFC) or Chartered Financial Analyst (CFA) designations, which demonstrate expertise in specific areas of financial planning.

Choosing Between a Financial Advisor and Financial Planner

When deciding between a financial advisor and a financial planner, it’s important to consider your specific financial needs and goals. If you primarily need assistance with investment management and want to focus on growing your wealth, a financial advisor may be the right choice for you. They can help you navigate the complexities of the financial markets and identify investment opportunities that align with your risk tolerance.

On the other hand, if you’re looking for a more comprehensive approach to financial planning, including retirement planning, tax planning, and estate planning, a financial planner may be the better option. Financial planners take a holistic view of your financial situation and can help you develop a customized plan to achieve your long-term goals. They consider factors such as your income, expenses, and risk tolerance to create a roadmap for your financial success.

Factors to Consider when Selecting a Financial Professional

When selecting a financial professional, there are several factors to consider. First, evaluate their experience and expertise in the specific areas of financial planning that are important to you. Look for professionals who have a track record of success and a solid understanding of the financial markets. Additionally, consider their communication style and whether they are a good fit for your personality and communication preferences.

It’s also important to inquire about their fee structure. Financial advisors and financial planners may charge fees in different ways, such as a percentage of assets under management, an hourly rate, or a flat fee. Understand how their fees are structured and ensure that you are comfortable with the costs involved.

How to Find a Qualified Financial Advisor or Financial Planner

Finding a qualified financial advisor or financial planner can be a daunting task, but there are several resources available to help you in your search. Start by asking for recommendations from friends, family, and colleagues who have had positive experiences with financial professionals. Additionally, you can consult professional organizations, such as the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA), which maintain directories of certified professionals.

When interviewing potential financial advisors or financial planners, ask about their approach to financial planning, their investment philosophy, and their track record of success. It’s also important to inquire about any potential conflicts of interest and how they are addressed. You want to ensure that the professional you choose has your best interests in mind and is committed to acting in a fiduciary capacity.

Understanding the Costs and Fees Involved

As with any professional service, there are costs and fees associated with working with a financial advisor or financial planner. It’s important to have a clear understanding of these costs before engaging their services. Financial advisors typically charge fees based on a percentage of the assets they manage. This fee structure is known as the “assets under management” (AUM) model. The percentage can vary depending on the size of the portfolio and the services provided.

Financial planners may charge fees based on a similar percentage of assets under management, but they may also charge a flat fee or an hourly rate for their services. Some financial planners offer fee-only services, meaning they do not earn commissions from the sale of financial products. This fee structure can help ensure that the advice you receive is unbiased and in your best interest.

The Importance of Regular Reviews and Check-ins

Once you’ve engaged the services of a financial advisor or financial planner, it’s important to maintain an ongoing relationship and have regular reviews and check-ins. Financial markets and personal circumstances can change over time, so it’s crucial to regularly assess your financial plan and make adjustments as needed. Your financial professional can help you stay on track towards your goals and make informed decisions based on your changing circumstances.

Regular reviews and check-ins also provide an opportunity to ask questions, discuss any concerns, and receive updates on the performance of your investments. It’s important to maintain open and honest communication with your financial advisor or financial planner to ensure that your financial plan continues to align with your goals and objectives.

Conclusion: Making the Right Decision for Your Financial Future

Understanding the distinctions between a financial advisor and a financial planner can help you make informed decisions about your financial future. While both roles offer valuable guidance and expertise, they differ in their areas of focus and the breadth of services they provide. By evaluating your specific financial needs and goals, considering the credentials and experience of potential professionals, and understanding the costs and fees involved, you can make the right decision for your financial well-being. Whether you choose a financial advisor or a financial planner, having a trusted professional by your side can help you navigate the complexities of the financial world and achieve your long-term goals.