How to Become a Certified Financial Planner

Are you passionate about finance and helping others achieve their financial goals? If so, becoming a certified financial planner (CFP) could be the next step in your career. A CFP is a highly respected and sought-after professional in the financial industry, providing valuable advice and guidance to individuals and businesses alike. With the ever-changing landscape of financial regulations and investment strategies, having a CFP designation gives you a competitive edge and instills trust in your clients.

In this article, we will explore the process of becoming a certified financial planner, the qualifications and requirements needed, and the benefits of obtaining this prestigious certification. Whether you are a recent college graduate or a seasoned financial professional looking to enhance your skillset, this guide will provide you with the necessary information to embark on your journey towards becoming a CFP. From the educational requirements to the examination process and ongoing professional development, we will cover it all. So, let’s dive in and discover how you can become a certified financial planner.

The Importance of Becoming a Certified Financial Planner

Becoming a certified financial planner is not only a personal achievement but also a testament to your dedication and expertise in the field of finance. As a CFP, you have demonstrated a high level of competency in financial planning, including areas such as retirement planning, investment management, estate planning, and tax strategies. This certification not only enhances your credibility but also allows you to provide comprehensive financial advice to your clients.

One of the key benefits of becoming a CFP is the trust it instills in your clients. When individuals seek financial advice, they want to work with someone who is knowledgeable, ethical, and trustworthy. By obtaining the CFP designation, you differentiate yourself from other financial professionals and position yourself as a trusted advisor. Clients are more likely to entrust their financial future to someone who has gone through the rigorous process of becoming a certified financial planner.

Furthermore, the financial industry is constantly evolving, with new regulations, investment products, and strategies emerging regularly. As a CFP, you are required to maintain your knowledge and skills through continuing education. This ongoing professional development ensures that you stay up-to-date with the latest industry trends and best practices, allowing you to provide the most relevant and effective advice to your clients. By investing in your education and staying current, you can confidently navigate the ever-changing financial landscape and deliver exceptional value to your clients.

Steps to Becoming a Certified Financial Planner

Becoming a certified financial planner involves a series of steps that require dedication, hard work, and commitment. While the process may seem daunting, the rewards are well worth the effort. Here are the key steps to becoming a CFP:

Education and Qualifications Required for Certification

The first step towards becoming a CFP is to meet the educational requirements set by the Certified Financial Planner Board of Standards (CFP Board). To be eligible for certification, you must hold a bachelor’s degree or higher from an accredited college or university. The degree can be in any discipline, although coursework in finance, accounting, economics, or a related field is highly recommended.

In addition to the educational requirement, you must also complete a series of specific coursework in financial planning. The CFP Board requires candidates to complete a comprehensive curriculum, covering topics such as investment planning, tax planning, retirement planning, estate planning, and insurance planning. These courses can be taken through an accredited college or university, or through a CFP Board-registered program.

Exam Preparation Tips for the CFP Exam

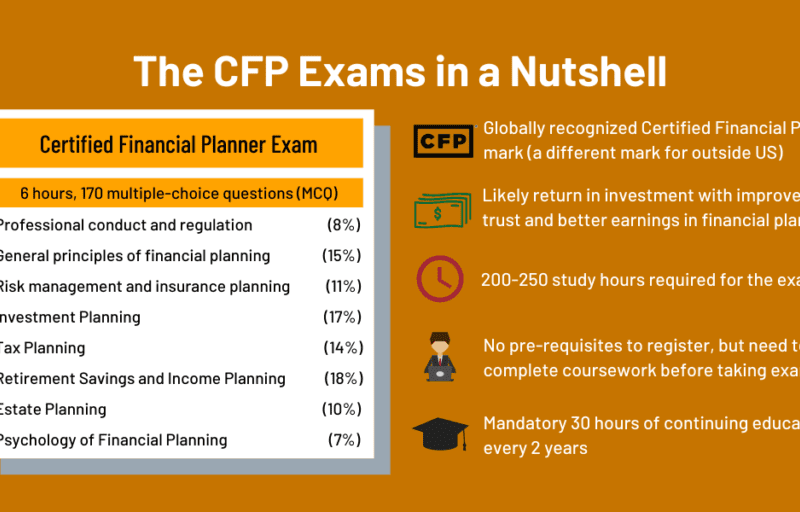

Once you have completed the required education, the next step is to prepare for the CFP exam. The CFP exam is a rigorous and comprehensive assessment of your knowledge and skills in financial planning. It consists of multiple-choice questions and case studies that test your ability to apply financial planning concepts to real-life scenarios.

To increase your chances of success, it is important to develop a solid study plan and dedicate sufficient time to exam preparation. Start by familiarizing yourself with the exam content outline provided by the CFP Board. This outline serves as a guide for the topics and subtopics that will be covered in the exam.

Next, gather study materials that align with the content outline. There are various resources available, including textbooks, online courses, practice exams, and study guides. Choose a combination of materials that suit your learning style and preferences.

As you study, make sure to allocate time for both concept review and practice questions. Understanding the underlying principles is essential, but so is practicing your problem-solving skills. The CFP exam requires you to analyze complex financial scenarios and make appropriate recommendations, so practice working through case studies and answering questions under timed conditions.

Finally, consider joining a study group or enrolling in a review course. Collaborating with others who are also preparing for the exam can provide valuable insights and support. Review courses, whether in-person or online, often offer structured study plans, expert instruction, and additional practice materials.

Finding the Right CFP Certification Program

To become a certified financial planner, you must complete a CFP Board-registered program. These programs are designed to provide the necessary education and preparation for the CFP exam. When choosing a program, consider factors such as reputation, curriculum, flexibility, and cost.

Look for programs that have a solid track record of producing successful CFP candidates. Ask for recommendations from professionals in the industry or seek advice from current CFPs. Additionally, review the program curriculum to ensure it aligns with the CFP Board’s required coursework. The program should cover all the essential areas of financial planning and provide a comprehensive understanding of the subject matter.

Flexibility is also an important consideration, especially if you are juggling work or other commitments. Look for programs that offer various learning formats, such as in-person classes, online courses, or a combination of both. This allows you to choose the format that best fits your schedule and learning preferences.

Lastly, consider the cost of the program. Pursuing a CFP certification is an investment in your future, but it’s important to find a program that offers a good balance between quality and affordability. Compare the tuition fees of different programs and evaluate the value they provide in terms of education, resources, and support.

Practical Experience and Ethics Requirements

In addition to completing the educational requirements and passing the CFP exam, candidates must also fulfill the practical experience requirement set by the CFP Board. This requirement ensures that CFP candidates have practical knowledge and experience in financial planning.

To meet the practical experience requirement, you must accumulate a minimum of 6,000 hours of relevant work experience. This experience can be obtained through a variety of roles, including financial planning, investment management, tax planning, or insurance planning. The experience must be completed within a 5-year period and can be gained before, during, or after completing the educational requirements.

In addition to practical experience, candidates must adhere to the CFP Board’s Code of Ethics and Standards of Conduct. These ethical standards set the expectations for professional behavior and client interactions. As a CFP, you are expected to act in the best interest of your clients and uphold the highest standards of integrity and professionalism.

Continuing Education and Maintaining CFP Certification

Becoming a certified financial planner is not the end of the journey; it’s just the beginning. Once you have obtained the CFP designation, you are required to maintain your certification through continuing education. This ongoing professional development ensures that you stay current with industry trends, regulations, and best practices.

The CFP Board requires CFPs to complete 30 hours of continuing education every two years, including at least 2 hours of ethics education. These hours can be fulfilled through various activities, such as attending conferences, taking courses, participating in webinars, or engaging in self-study. It’s important to choose continuing education opportunities that align with your professional goals and interests, allowing you to expand your knowledge and enhance your skills.

Maintaining your CFP certification also requires adherence to the CFP Board’s ethical standards. As a CFP, you are expected to uphold the highest level of professionalism and act in the best interest of your clients. Violations of the ethical standards can result in disciplinary action, including the revocation of your certification. Therefore, it’s crucial to familiarize yourself with the Code of Ethics and Standards of Conduct and integrate them into your daily practice.

Benefits and Career Opportunities for Certified Financial Planners

Becoming a certified financial planner opens up a world of career opportunities and benefits. As a CFP, you have the skills and knowledge to provide comprehensive financial planning advice to individuals, families, and businesses. You can work as an independent financial planner, join a financial planning firm, or even start your own practice.

The demand for financial planners is growing, driven by the increasing complexity of financial decisions and the need for professional guidance. With a CFP designation, you are well-positioned to meet this demand and build a successful career in the financial industry.

In addition to career opportunities, becoming a CFP also offers financial rewards. According to the CFP Board, CFP professionals earn, on average, 40% more than their non-certified counterparts. This higher earning potential is a reflection of the value that clients place on the expertise and guidance provided by CFPs.

Furthermore, as a CFP, you have the opportunity to make a positive impact on the lives of your clients. Financial planning is not just about numbers; it’s about helping individuals and families achieve their financial goals and dreams. By providing personalized advice and guidance, you can help clients navigate challenging financial situations, plan for retirement, save for their children’s education, and protect their assets.

Conclusion: Taking the First Step towards Becoming a Certified Financial Planner

Becoming a certified financial planner is a rewarding and fulfilling career path for those passionate about finance and helping others. It requires dedication, hard work, and ongoing commitment to professional development. However, the benefits and opportunities that come with the CFP designation are well worth the effort.

By following the steps outlined in this guide, you can embark on your journey towards becoming a certified financial planner. Start by meeting the educational requirements, preparing for the CFP exam, and gaining practical experience. Choose a reputable CFP certification program that aligns with your goals and preferences. Once you have obtained the CFP designation, continue to invest in your professional development through continuing education and adhering to the CFP Board’s ethical standards.

Remember, becoming a CFP is not just about the certification itself; it’s about the knowledge, skills, and trust that you gain along the way. By becoming a certified financial planner, you can make a lasting impact on the financial well-being of your clients and build a successful and fulfilling career in the financial industry. So, take the first step today and embark on your journey towards becoming a certified financial planner.