What Is Peer-to-Peer Lending and Its Benefits

Are you tired of dealing with traditional banks and their stringent lending requirements? Peer-to-peer lending might be the solution you’ve been searching for. In this article, we explore the concept of peer-to-peer lending and its benefits for both borrowers and investors.

How Does Peer-to-Peer Lending Work?

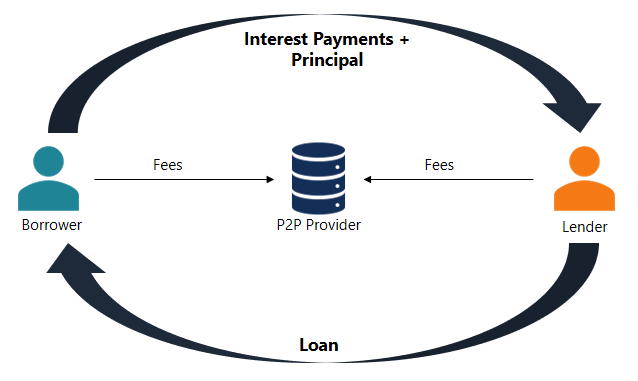

Peer-to-peer lending, also known as P2P lending, is a method of borrowing and lending without the involvement of traditional financial institutions. Instead, individuals connect directly through online platforms, allowing borrowers to access loans quickly and investors to earn attractive returns on their investments.

The process begins with borrowers creating loan listings on P2P lending platforms, detailing the amount they need, the purpose of the loan, and their creditworthiness. Investors then review these listings and choose which loans they want to fund based on their risk appetite and investment goals.

Once a loan is funded, borrowers receive the requested funds, and they make regular payments, including principal and interest, back to the investors. P2P lending platforms facilitate the entire process, handling loan servicing, payments, and collections.

Peer-to-peer lending operates on the principle of spreading risk across multiple investors. Instead of a single financial institution carrying the risk, investors diversify their portfolios by investing in various loans. This reduces the risk of default and potentially enhances returns.

Benefits of Peer-to-Peer Lending for Borrowers

One of the main advantages of peer-to-peer lending is its accessibility. Unlike traditional banks that often have strict eligibility criteria, P2P lending platforms provide opportunities for individuals with less-than-ideal credit scores or limited collateral to secure the funding they need.

Additionally, the online nature of P2P lending makes the process faster and more convenient for borrowers. Loan applications can be completed from the comfort of their homes, and approvals can sometimes be obtained within a few days. This is a stark contrast to the lengthy process involved in securing a loan from a traditional bank, which often requires multiple visits and extensive paperwork.

Another benefit for borrowers is the potential for lower interest rates. P2P lending platforms operate with lower overhead costs compared to traditional banks, allowing them to offer more competitive rates. This can result in significant savings over the life of a loan.

Furthermore, P2P lending provides borrowers with more flexibility. Loans can be used for various purposes, such as debt consolidation, home improvement, or business expansion. Borrowers have the freedom to choose the loan terms and repayment schedule that best suit their needs.

In summary, peer-to-peer lending offers borrowers accessibility, convenience, competitive interest rates, and flexibility, making it an attractive alternative to traditional lending options.

Benefits of Peer-to-Peer Lending for Investors

Peer-to-peer lending also presents numerous benefits for investors looking to diversify their portfolios and earn attractive returns.

Firstly, P2P lending provides an opportunity to earn potentially higher returns compared to traditional investment options, such as savings accounts or government bonds. Investors can lend directly to individuals and earn interest on their investments, often at rates higher than what they would receive from traditional fixed-income assets.

Moreover, investors have the ability to diversify their portfolios across a range of loans, spreading their risk and minimizing the impact of any defaults. P2P lending platforms typically provide detailed information about borrowers, including credit history and risk ratings, enabling investors to make informed decisions.

Another advantage is the passive income generated through peer-to-peer lending. Once investors have funded a loan, they can sit back and receive monthly repayments, including both principal and interest. This can be particularly appealing for individuals looking to supplement their regular income or grow their wealth over time.

Furthermore, P2P lending offers investors the flexibility to choose the level of risk they are comfortable with. By spreading their investments across different loans with varying risk profiles, investors can tailor their portfolios to align with their investment objectives and risk appetite.

In conclusion, peer-to-peer lending provides investors with the potential for higher returns, diversification, passive income, and flexibility, positioning it as an attractive investment avenue.

Peer-to-Peer Lending Statistics

To gain a better understanding of the growing popularity and potential of peer-to-peer lending, let’s take a look at some relevant statistics:

- According to Statista, the global peer-to-peer lending market was valued at approximately $67 billion in 2020 and is projected to reach $558 billion by 2027.

- The largest P2P lending market is in China, followed by the United States and the United Kingdom.

- Research from Transparency Market Research suggests that the compound annual growth rate of the P2P lending market will be around 48% from 2021 to 2028.

- As of 2021, LendingClub, Prosper, and Funding Circle are among the leading P2P lending platforms globally.

These statistics highlight the significant growth potential and increasing acceptance of peer-to-peer lending as a viable alternative to traditional banking.

Risks and Challenges of Peer-to-Peer Lending

While peer-to-peer lending comes with numerous benefits, it is important to be aware of the potential risks and challenges associated with this form of lending.

One of the main risks for investors is the possibility of loan defaults. Although P2P lending platforms conduct risk assessments, there is still a chance that borrowers may default on their payments. This can result in a loss of invested capital for investors.

Additionally, the lack of regulation in some jurisdictions can pose risks, as it may lead to inadequate borrower screening or insufficient investor protection. It is essential for investors to thoroughly research and choose reputable P2P lending platforms that adhere to regulatory standards.

For borrowers, the main challenge is the potential for higher interest rates compared to traditional bank loans for individuals with strong credit profiles. While P2P lending offers opportunities for individuals with lower credit scores, they may have to accept higher interest rates to compensate for the increased risk perceived by investors.

Another challenge for borrowers is the possibility of limited loan options. P2P lending platforms may have specific eligibility criteria or loan limits that could restrict some borrowers from obtaining the desired amount of funding.

Overall, while peer-to-peer lending presents attractive benefits, it is crucial for both borrowers and investors to carefully assess the risks and challenges involved and make informed decisions.

Peer-to-Peer Lending vs Traditional Lending

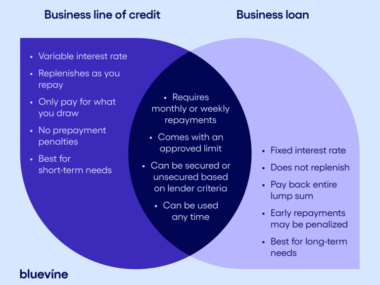

Peer-to-peer lending differs from traditional lending in several key aspects.

Firstly, peer-to-peer lending eliminates the need for intermediaries, such as banks or credit unions. This results in lower overhead costs, which can translate to lower interest rates for borrowers and potentially higher returns for investors.

Additionally, P2P lending offers a more streamlined and efficient process compared to traditional lending. Borrowers can complete loan applications online, eliminating the need for extensive paperwork and multiple visits to a bank. Loan approvals can be obtained within days, providing borrowers with faster access to funds.

Furthermore, P2P lending platforms often use innovative technology and algorithms to assess borrower creditworthiness. This allows for a more holistic evaluation, taking into account non-traditional factors that traditional banks may overlook.

On the other hand, traditional lending institutions generally have more rigid eligibility criteria, requiring higher credit scores and collateral. While this ensures a lower risk for lenders, it can exclude individuals with less-than-ideal credit histories or limited assets from obtaining loans.

In summary, peer-to-peer lending offers a more accessible, convenient, and potentially cost-effective alternative to traditional lending options.

How to Get Started with Peer-to-Peer Lending

If you’re interested in exploring peer-to-peer lending as a borrower or an investor, here are some steps to get started:

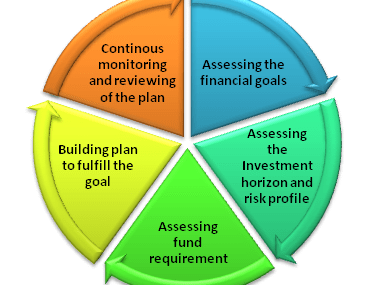

- Research P2P lending platforms: Look for reputable platforms that align with your goals and risk appetite. Read reviews and compare fees, interest rates, and loan terms.

- Create an account: Sign up on your chosen P2P lending platform and complete the necessary registration process, which may include identity verification and financial information.

- Understand the platform: Familiarize yourself with the platform’s features, loan listings, and investment options. Take the time to understand how the platform operates and the risks involved.

- Assess loan listings or investment opportunities: Carefully review loan listings or investment opportunities, considering factors such as borrower creditworthiness, loan purpose, interest rates, and repayment terms.

- Start small: As a borrower, consider starting with a smaller loan amount to build trust and establish a positive repayment record. As an investor, diversify your investments across multiple loans to mitigate risk.

- Monitor and manage your investments: Keep track of your loan repayments or investment returns. Regularly assess your portfolio and make adjustments as needed.

Remember, it’s important to conduct thorough research, understand the risks involved, and make informed decisions when engaging in peer-to-peer lending.

Peer-to-Peer Lending Platforms to Consider

There are several notable peer-to-peer lending platforms available for both borrowers and investors. Here are a few platforms worth considering:

- LendingClub: One of the largest P2P lending platforms in the United States, offering personal loans, business loans, and patient financing.

- Prosper: Another prominent P2P lending platform in the United States, providing personal loans for various purposes, including debt consolidation and home improvement.

- Funding Circle: A leading P2P lending platform in the United Kingdom, specializing in small business loans.

- Zopa: One of the oldest P2P lending platforms, operating in the United Kingdom, offering personal loans and savings accounts.

- Mintos: A European P2P lending platform that connects investors with borrowers from around the world, providing various loan types.

These platforms have established track records, robust risk assessment procedures, and user-friendly interfaces, making them popular choices for individuals interested in peer-to-peer lending.

Conclusion

Peer-to-peer lending has emerged as a viable alternative to traditional banking, offering numerous benefits for both borrowers and investors. Its accessibility, convenience, potentially lower interest rates, and flexibility make it an attractive option for individuals seeking loans. Simultaneously, investors can diversify their portfolios, earn potentially higher returns, and enjoy passive income.

However, it is important to be aware of the risks and challenges associated with peer-to-peer lending, such as the possibility of loan defaults and the lack of regulation in some jurisdictions. Thorough research, careful assessment of platforms, and informed decision-making are crucial.

If you’re considering peer-to-peer lending, take the time to explore reputable platforms, understand their processes, and start small to gain confidence and minimize risk. Peer-to-peer lending can be an exciting avenue for both borrowers and investors, providing new opportunities in the evolving landscape of personal finance.