Revenue Based Financing And It Benefits

Are you a business owner looking for alternative financing options to fuel your growth? Look no further! Revenue Based Financing might just be the solution you’ve been searching for. In this article, we will explore the world of Revenue Based Financing and how it can help businesses access the funds they need to scale without giving up equity or taking on restrictive loans.

What is revenue-based financing?

Revenue Based Financing, also known as RBF, is a unique form of funding that allows businesses to secure capital based on their future revenue projections. Unlike traditional loans, RBF providers offer funding in exchange for a percentage of future revenue until a predetermined repayment amount is reached. This flexible financing option is particularly attractive to startups and SMEs who may not qualify for conventional bank loans or do not want to dilute their ownership.

Revenue Based Financing is a relatively new concept that has gained popularity in recent years. It offers businesses an alternative to traditional debt financing and equity funding. Instead of paying back a fixed amount of principal and interest, businesses repay the funding through a percentage of their revenue. This means that during slower periods, when revenue is lower, the repayment amount is also reduced, easing the financial burden on the business.

How does revenue-based financing work?

Revenue Based Financing works by providing businesses with upfront capital in exchange for a percentage of their future revenue. The repayment structure is typically based on a fixed percentage of monthly revenue, known as the “revenue share.” This percentage can range from 2% to 10%, depending on the terms of the agreement and the financial health of the business.

The repayment period is determined by a predetermined “cap,” which is the total amount the business will repay to the RBF provider. Once the cap is reached, the repayment obligations end, regardless of the original funding amount. This means that if the business experiences rapid growth and surpasses the revenue projections, the repayment period may be shorter than anticipated, resulting in a lower overall cost of financing.

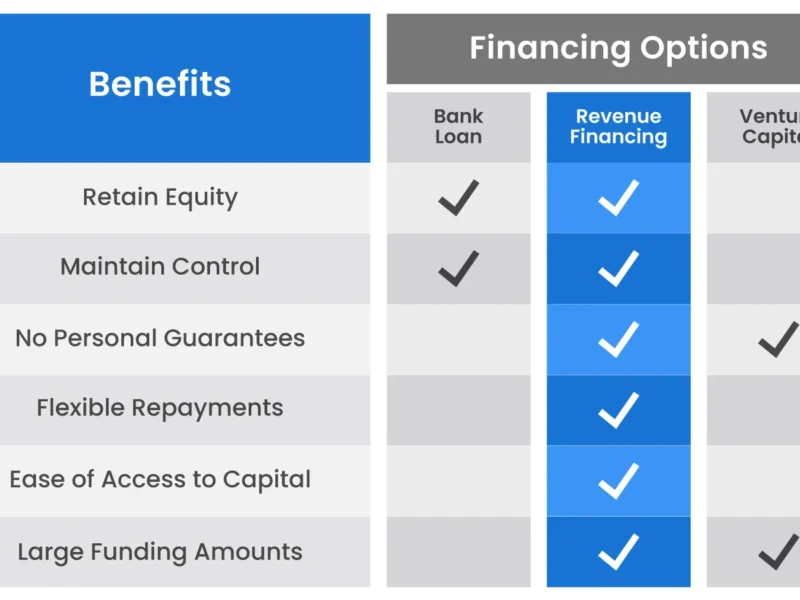

Benefits of revenue-based financing

No dilution of ownership: Unlike equity financing, Revenue Based Financing allows businesses to secure funding without giving up ownership or control of their company. This is particularly beneficial for entrepreneurs who want to retain full ownership of their business while still accessing the capital needed to grow.

Flexible repayment structure: RBF offers businesses a flexible repayment structure that is tied to their revenue. This means that during slower periods, when revenue is lower, the repayment amount is also reduced, easing the financial burden on the business. This flexibility can be especially advantageous for seasonal businesses or those with fluctuating revenue streams.

Quick and easy access to capital: Revenue Based Financing offers a faster and more streamlined application process compared to traditional bank loans. RBF providers typically focus on the future revenue potential of the business rather than historical financials, making it easier for startups and SMEs to qualify for funding. This quick access to capital can be crucial for businesses that need funds to seize growth opportunities or overcome temporary cash flow challenges.

Revenue-based financing vs. traditional financing

While Revenue Based Financing offers several advantages, it is important to understand how it differs from traditional financing options. Here are some key differences to consider:

Repayment structure: Traditional loans typically require fixed monthly payments of principal and interest over a set period of time. In contrast, Revenue Based Financing offers a repayment structure based on a percentage of monthly revenue. This means that the repayment amount fluctuates with the business’s revenue, providing more flexibility during slower periods.

Collateral requirements: Traditional financing often requires collateral, such as real estate or inventory, to secure the loan. In contrast, Revenue Based Financing is typically unsecured, meaning that businesses do not need to pledge specific assets as collateral. This can be beneficial for businesses that may not have sufficient collateral or do not want to put their assets at risk.

Qualification criteria: Traditional loans are often based on a business’s credit history, financial statements, and collateral. Revenue Based Financing, on the other hand, focuses on the future revenue potential of the business. This means that startups and SMEs with limited financial history or less-than-perfect credit scores may have a better chance of qualifying for RBF.

Eligibility criteria for revenue-based financing

While Revenue Based Financing offers a more accessible funding option for many businesses, it is important to understand the eligibility criteria before pursuing this funding avenue. Here are some common requirements that RBF providers may consider:

Minimum revenue: Most RBF providers require a minimum monthly or annual revenue threshold. This ensures that the business has a steady revenue stream to support the repayment obligations. The minimum revenue requirement can vary depending on the RBF provider and the industry.

Profitability: Some RBF providers may require the business to be profitable or have a positive cash flow. This is to ensure that the business can generate enough revenue to cover the repayment obligations and still have sufficient funds for operations and growth.

Business age: While Revenue Based Financing is available for startups, some RBF providers may prefer businesses that have been in operation for a certain period of time, typically at least 6 to 12 months. This requirement helps assess the stability and revenue-generating potential of the business.

Industry and business model: RBF providers may have specific preferences for certain industries or business models. Some industries, such as technology or software-as-a-service (SaaS), may be more attractive to RBF providers due to their potential for high growth and recurring revenue.

How to apply for revenue-based financing

If you believe that Revenue Based Financing is the right funding option for your business, here are the steps to apply for this type of financing:

Research RBF providers: Start by researching and identifying reputable RBF providers that specialize in your industry or business model. Look for providers with a track record of working with businesses similar to yours and offering favorable terms.

Prepare your financials: While Revenue Based Financing may not require extensive financial documentation like traditional loans, it is still important to have your financials in order. Prepare documents such as income statements, balance sheets, and cash flow projections to demonstrate the revenue-generating potential of your business.

Craft a compelling pitch: RBF providers evaluate businesses based on their growth potential and revenue projections. Craft a compelling pitch that highlights your unique value proposition, market opportunity, and revenue growth strategy. Clearly articulate how the funding will be used to fuel growth and generate returns for both your business and the RBF provider.

Submit your application: Once you have gathered all the necessary documents and crafted your pitch, submit your application to the selected RBF providers. Be prepared to answer any additional questions or provide further information during the due diligence process.

Evaluate offers: If your application is successful, you may receive offers from multiple RBF providers. Take the time to carefully evaluate each offer, considering factors such as the revenue share percentage, repayment cap, and any additional terms or fees. Choose the offer that aligns best with your business’s needs and growth objectives.

Tips for success with revenue-based financing

To maximize the benefits of Revenue Based Financing and set your business up for success, consider the following tips:

Thoroughly assess your revenue projections: Since Revenue Based Financing relies on future revenue, it is crucial to have accurate and realistic revenue projections. Work closely with your finance team or a financial advisor to ensure your projections are based on comprehensive market research and a deep understanding of your business’s growth potential.

Maintain open communication with your RBF provider: Revenue Based Financing is a partnership between your business and the RBF provider. Maintain open and transparent communication with your provider, sharing regular updates on your business’s performance and growth trajectory. This can help build trust and strengthen the relationship over time.

Monitor your financial performance: Keep a close eye on your financial performance and revenue trends. Regularly review your revenue metrics to ensure you are on track to meet the repayment obligations. If you anticipate any significant changes in revenue, proactively communicate with your RBF provider to explore potential solutions or adjustments to the repayment structure.

Use the funding strategically: Revenue Based Financing provides businesses with capital to fuel growth. Use the funding strategically to invest in revenue-generating initiatives, such as marketing campaigns, product development, or expanding your sales team. By allocating the funds wisely, you can maximize the return on investment and accelerate your business’s growth trajectory.

Case studies: Successful businesses that used revenue-based financing

Tech Startup X: Tech Startup X, a software-as-a-service (SaaS) company, used Revenue Based Financing to scale their operations and expand their customer base. With the funding, they were able to invest in marketing campaigns, hire additional developers, and enhance their product offerings. The flexible repayment structure allowed them to manage their cash flow during the early stages of growth, and they were able to repay the funding ahead of schedule.

E-commerce Retailer Y: E-commerce Retailer Y utilized Revenue Based Financing to launch a new product line and increase their inventory. The funding enabled them to meet the growing demand from their customer base and expand their market reach. By leveraging the flexible repayment structure, they were able to align their repayment obligations with their revenue growth, ensuring a sustainable and manageable financing solution.

Common misconceptions about revenue-based financing

It is expensive: While Revenue Based Financing may have a higher cost compared to traditional bank loans, it is important to consider the benefits and flexibility it offers. The overall cost of financing can vary depending on factors such as the revenue share percentage, repayment cap, and the business’s revenue growth. It is crucial to carefully evaluate the terms and assess the potential return on investment before making a decision.

It is only for struggling businesses: Revenue Based Financing is not limited to struggling businesses. It is a viable funding option for startups and SMEs looking to scale their operations without giving up ownership or taking on restrictive loans. Successful businesses with strong revenue potential can also benefit from RBF by accessing capital to fuel their growth initiatives.

Conclusion and final thoughts on revenue-based financing

Revenue Based Financing offers businesses a flexible and accessible funding option to fuel their growth without giving up equity or taking on restrictive loans. By leveraging future revenue projections, businesses can secure capital and repay the funding based on their revenue performance. While RBF may not be suitable for every business, it provides an alternative financing solution that can be particularly attractive to startups and SMEs.

Before pursuing Revenue Based Financing, it is important to carefully evaluate the eligibility criteria, consider the benefits and drawbacks, and thoroughly assess your business’s revenue projections. By doing so, you can make an informed decision and choose the financing option that aligns best with your business’s growth objectives.

If you’re ready to think outside the box and explore innovative financing solutions, Revenue Based Financing might just be the key to unlocking your business’s growth potential. Take the time to research reputable RBF providers, prepare your financials, and craft a compelling pitch that showcases your business’s unique value proposition. With the right approach and strategic use of funding, Revenue Based Financing can be a powerful tool to propel your business to new heights.