Understanding the Basics of a Business Line of Credit

A business line of credit is a financing option that provides businesses with a flexible source of funds. It works in a similar way to a credit card, allowing you to borrow money up to a predetermined credit limit. Unlike traditional loans, where you receive a lump sum upfront, a line of credit allows you to borrow and repay funds as needed.

One of the key benefits of a business line of credit is its flexibility. You have the freedom to use the funds for various business expenses, such as inventory, payroll, or equipment. This can be particularly helpful for managing cash flow fluctuations, as you only pay interest on the amount you borrow.

Another advantage of a business line of credit is that it provides a safety net for unexpected expenses. Instead of relying on personal savings or high-interest credit cards, you can tap into your line of credit to cover unexpected costs. This can help you avoid disruption to your business operations and maintain stability.

Benefits of a Business Line of Credit

There are several benefits that come with utilizing a business line of credit. Firstly, it provides you with a safety net for managing unexpected expenses. Whether it’s a sudden equipment breakdown or an unexpected inventory order, having access to a line of credit can help you navigate these situations without compromising your business’s financial stability.

Secondly, a business line of credit offers flexibility in managing cash flow fluctuations. In a typical business, there are times when revenue is low, but expenses remain constant. During these periods, a line of credit can help bridge the gap and ensure that your business operations continue smoothly. You can borrow funds as needed and repay them when your cash flow improves, reducing the financial strain on your business.

Furthermore, a business line of credit allows you to take advantage of growth opportunities. Suppose you come across a bulk discount on inventory or an opportunity to expand your business. In that case, having a line of credit can provide you with the necessary funds to seize these opportunities without delay. This can give your business a competitive edge and help you capitalize on favorable market conditions.

How Does a Business Line of Credit Work?

To understand how a business line of credit works, let’s break it down step by step. Firstly, you need to apply for a line of credit with a financial institution or lender. The application process typically involves providing information about your business’s financials, such as revenue, expenses, and credit history.

Once your application is approved, you will be assigned a credit limit. This is the maximum amount you can borrow from the line of credit. It’s important to note that you are not obligated to borrow the full amount, and you should only borrow what you need to avoid unnecessary interest charges.

When you need funds, you can access them by writing a check, transferring funds online, or using a credit card linked to your line of credit. The borrowed amount is added to your outstanding balance, and you will be charged interest on that amount.

As you repay the borrowed funds, your available credit limit replenishes. This means that you can borrow and repay funds as needed, as long as you stay within your credit limit. It’s essential to make regular payments to avoid late fees and maintain a positive relationship with your lender.

Qualifying for a Business Line of Credit

Qualifying for a business line of credit depends on several factors, including your business’s financial health and creditworthiness. Lenders typically evaluate your revenue, expenses, cash flow, and credit history to assess your ability to repay the borrowed funds.

Established businesses with a solid track record and steady revenue are more likely to qualify for a line of credit. Lenders want to ensure that you have the means to repay the borrowed funds and that your business is not at risk of defaulting.

Startups and newer businesses may find it more challenging to qualify for a line of credit. In these cases, lenders may require additional documentation, such as personal guarantees or collateral, to mitigate the risk. It’s important to be prepared and have a clear understanding of your business’s financials before applying for a line of credit.

Applying for a Business Line of Credit

When applying for a business line of credit, it’s crucial to gather all the necessary documentation and present a strong case to the lender. Here are some key steps to follow:

- Prepare your financial statements: Lenders will want to review your income statements, balance sheets, and cash flow statements to assess your business’s financial health. Ensure that these documents are up to date and accurately reflect your business’s financial position.

- Gather supporting documents: Depending on the lender, you may need to provide additional documents, such as tax returns, bank statements, and business licenses. Be prepared to present these documents to support your application.

- Create a business plan: A well-crafted business plan can help demonstrate your understanding of your industry, market, and growth potential. It’s essential to showcase your business’s unique value proposition and outline your strategies for success.

- Research lenders: Different lenders have different requirements and terms for business lines of credit. It’s important to research and compare lenders to find the one that best suits your business’s needs. Consider factors such as interest rates, repayment terms, and customer reviews.

- Submit your application: Once you have gathered all the necessary documentation, you can submit your application to the lender. Be prepared to answer any additional questions or provide further clarification if requested.

Managing and Using a Business Line of Credit Effectively

To make the most of your business line of credit, it’s important to manage it effectively. Here are some tips to help you use your line of credit wisely:

- Borrow responsibly: Only borrow the funds you need and have a plan for how you will use them. Avoid using your line of credit for personal expenses or non-business-related purchases.

- Make timely payments: Pay attention to the due dates and make regular payments to avoid late fees and maintain a positive relationship with your lender. Consider setting up automatic payments to ensure you never miss a payment.

- Monitor your credit limit: Keep an eye on your available credit limit and avoid exceeding it. Going over your credit limit can result in penalties and affect your credit score.

- Use it strategically: Use your line of credit to take advantage of growth opportunities or manage cash flow fluctuations. However, avoid relying on it as a long-term solution for ongoing operational expenses.

- Review your terms: Periodically review the terms of your line of credit, including interest rates and repayment terms. If you find better terms elsewhere, consider refinancing to save on interest costs.

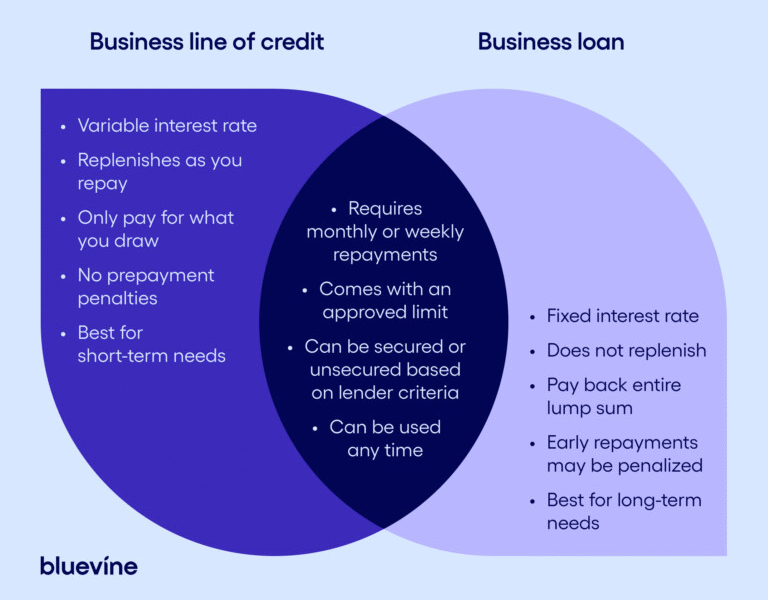

Business Line of Credit vs. Traditional Business Loans

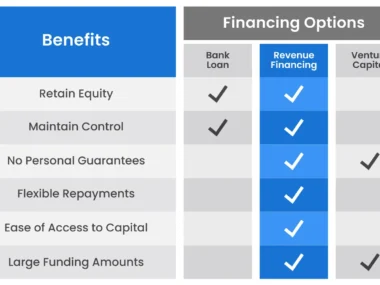

When considering financing options for your business, it’s important to understand the differences between a business line of credit and traditional business loans. While both options provide access to funds, they serve different purposes and have distinct characteristics.

A business line of credit offers more flexibility than a traditional loan. With a line of credit, you can borrow and repay funds as needed, while a loan provides a lump sum upfront that you repay over a fixed term. This makes a line of credit a better option for managing cash flow fluctuations and unexpected expenses.

In terms of interest rates, a line of credit often has a variable rate, meaning it can fluctuate based on market conditions. On the other hand, traditional loans usually have a fixed interest rate, providing more stability in terms of monthly payments.

When it comes to approval and access to funds, a line of credit may be easier to obtain than a traditional loan. Lenders are often more flexible with credit requirements for lines of credit, making it an option for both established businesses and startups.

Finding the Right Lender for a Business Line of Credit

Finding the right lender for your business line of credit is crucial for a positive borrowing experience. Here are some factors to consider when choosing a lender

- Reputation and reliability: Research the lender’s reputation and check customer reviews to ensure they have a track record of providing reliable and transparent services.

- Interest rates and fees: Compare the interest rates and fees offered by different lenders to ensure you are getting the best deal. Pay attention to any hidden fees or charges that may impact the total cost of borrowing.

- Customer service: A lender with excellent customer service can provide support and address any concerns or issues that may arise throughout the borrowing process. Look for lenders that are responsive and prioritize customer satisfaction.

- Flexibility and terms: Consider the flexibility of the lender’s line of credit terms. Look for options that align with your business’s needs and provide favorable repayment terms.

- Additional services: Some lenders may offer additional services, such as online banking or financial management tools, which can enhance your borrowing experience. Consider these offerings when making your decision.

Conclusion

A business line of credit can be an invaluable financing tool for businesses of all sizes. Its flexibility, safety net for unexpected expenses, and ability to manage cash flow fluctuations make it a popular choice among business owners. By understanding how a line of credit works, qualifying for it, and using it effectively, you can leverage this financing option to support your business’s growth and success. Remember to research lenders, compare terms, and choose a reputable institution to ensure a positive borrowing experience.