The Role of a Financial Advisor

Financial advisors play a crucial role in helping individuals and families navigate the complex world of investments and money management. They are trained professionals who provide expert guidance and advice on various financial matters. A financial advisor’s primary goal is to help their clients make informed decisions that will ultimately lead to financial success. Whether you’re planning for retirement, saving for your child’s education, or simply looking to grow your wealth, a financial advisor can help you create a customized strategy tailored to your unique needs.

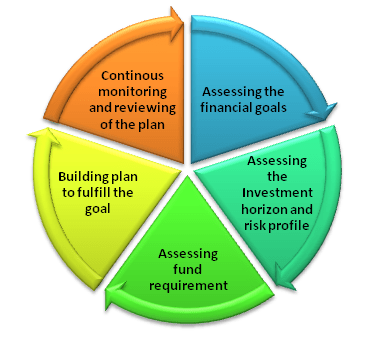

One of the main responsibilities of a financial advisor is to assess their clients’ financial situation and goals. They take the time to listen and understand their clients’ objectives, as well as their risk tolerance and time horizon. This information allows them to develop a comprehensive financial plan that outlines specific steps to achieve these goals. A financial advisor acts as a partner in this journey, providing ongoing support and guidance as their clients’ circumstances and goals evolve.

Another important role of a financial advisor is to stay up-to-date with the latest market trends and investment strategies. The financial landscape is constantly changing, and it requires a deep understanding of the market to make informed investment decisions. Financial advisors have access to a wealth of resources and research, allowing them to provide their clients with the most current and relevant advice. This expertise helps clients make sound investment choices and optimize their portfolios for long-term growth.

In addition to investment guidance, financial advisors also provide a range of other services. They can assist with tax planning and optimization, helping clients minimize their tax liabilities and maximize their savings. Financial advisors can also help with retirement planning, ensuring their clients have a solid plan in place to support them during their golden years. Estate planning is another area where financial advisors can provide valuable assistance, helping clients protect and distribute their assets according to their wishes.

Overall, the role of a financial advisor is multifaceted and encompasses various aspects of financial planning and wealth management. They are not only experts in their field but also trusted partners who are committed to their clients’ financial success. By working with a financial advisor, individuals and families can gain peace of mind knowing that they have a knowledgeable professional guiding them every step of the way.

Why You Need a Financial Advisor

Navigating the complex world of investments and money management can be challenging, especially if you don’t have a background in finance. That’s where a financial advisor comes in. They are trained professionals who can provide expert guidance and advice to help you make informed decisions and achieve your financial goals. Here are some reasons why you may need a financial advisor:

1. Expertise and Knowledge: Financial advisors have a deep understanding of the financial industry and the various investment options available. They stay up-to-date with the latest market trends and investment strategies, ensuring that their advice is based on current information. This expertise can help you make sound investment choices and optimize your portfolio for long-term growth.

2. Tailored Financial Plan: Everyone’s financial situation is unique, and a financial advisor can help you create a customized plan that aligns with your specific goals and needs. They take the time to understand your objectives, risk tolerance, and time horizon, and develop a comprehensive financial plan that outlines specific steps to achieve these goals. This personalized approach ensures that your financial plan is tailored to your circumstances and maximizes your chances of success.

3. Objective Advice: Emotions can often cloud judgment when it comes to financial decisions. A financial advisor provides objective advice, helping you make rational choices based on your long-term goals rather than short-term market fluctuations. They act as a sounding board, offering unbiased guidance and helping you stay on track even during turbulent times.

4. Time and Convenience: Managing your finances can be time-consuming, especially if you have a busy schedule. A financial advisor can take care of the day-to-day management of your investments, saving you time and providing you with peace of mind. They handle the research, analysis, and monitoring, allowing you to focus on other aspects of your life.

5. Long-Term Relationships: Building a long-term relationship with a financial advisor can be incredibly valuable. They get to know you and your financial goals intimately, and they can provide ongoing support and guidance as your circumstances and goals evolve. This continuity ensures that your financial plan remains aligned with your changing needs and helps you stay on track to achieve your long-term goals.

In conclusion, a financial advisor can provide the expertise, knowledge, and guidance you need to navigate the complex world of investments and money management. Whether you’re just starting your financial journey or looking to optimize your existing portfolio, a financial advisor can help you make informed decisions and achieve your financial goals.

How to Choose the Right Financial Advisor

Choosing the right financial advisor is a crucial decision that can have a significant impact on your financial future. With so many options available, it’s important to do your due diligence and consider several factors before making a choice. Here are some steps to help you choose the right financial advisor:

1. Identify Your Needs: Before you start your search for a financial advisor, it’s important to identify your specific needs and goals. Are you looking for help with retirement planning, investment management, tax optimization, or a combination of these services? Understanding your needs will help you narrow down your options and find a financial advisor who specializes in the areas that are most important to you.

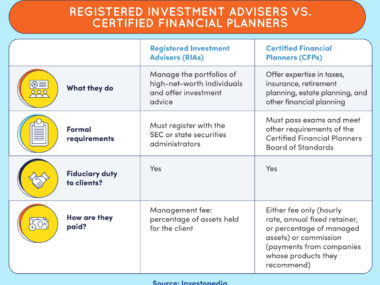

2. Research and Credentials: Once you have identified your needs, it’s time to research potential financial advisors. Look for advisors who are licensed and regulated by reputable organizations such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). These regulatory bodies ensure that financial advisors meet certain standards of professionalism and ethics.

3. Evaluate Experience and Expertise: Experience and expertise are key factors to consider when choosing a financial advisor. Look for advisors who have a proven track record of success and have worked with clients in similar financial situations. Consider their educational background, certifications, and professional affiliations. It’s also important to assess their knowledge and understanding of the financial markets and investment strategies.

4. Fee Structure: Financial advisors can charge fees in different ways, and it’s important to understand how they are compensated. Some advisors charge a percentage of the assets they manage, while others charge an hourly fee or a flat fee. Make sure you understand the fee structure and how it aligns with your financial goals and budget.

5. Compatibility and Trust: Building a strong relationship with your financial advisor is crucial, so it’s important to find someone you feel comfortable working with. Schedule an initial consultation with potential advisors to get a sense of their communication style and whether they understand your goals and concerns. Trust your instincts and choose an advisor who you believe has your best interests at heart.

6. Ongoing Support and Communication: Financial planning is a lifelong process, and it’s important to choose a financial advisor who provides ongoing support and communication. Ask potential advisors about their availability and how often they will meet with you to review your progress and make any necessary adjustments to your financial plan. Clear and regular communication is essential for a successful partnership.

In conclusion, choosing the right financial advisor is a crucial step in achieving your financial goals. By taking the time to evaluate your needs, research potential advisors, and consider factors such as experience, credentials, and compatibility, you can find a financial advisor who will provide the expertise and guidance you need to succeed.

Common Financial Advisor Services

Financial advisors offer a wide range of services to help individuals and families manage their finances and achieve their financial goals. These services can vary depending on the advisor’s expertise and the specific needs of their clients. Here are some common financial advisor services:

1. Financial Planning: Financial planning is the foundation of any successful financial strategy. Financial advisors work closely with their clients to develop comprehensive financial plans that outline specific steps to achieve their goals. This includes assessing their clients’ financial situation, setting objectives, and creating a roadmap to reach these goals. Financial planning covers various areas such as budgeting, saving, investing, retirement planning, tax optimization, and estate planning.

2. Investment Management: Investment management is a key service provided by financial advisors. They help their clients make informed investment decisions and manage their investment portfolios. Financial advisors have access to a wealth of research and analysis, allowing them to identify investment opportunities and diversify their clients’ portfolios. They monitor the performance of investments and make any necessary adjustments to optimize returns and manage risk.

3. Retirement Planning: Many individuals and families turn to financial advisors for help with retirement planning. Financial advisors assess their clients’ retirement goals, determine the amount of savings needed, and develop a plan to achieve these goals. They consider factors such as the client’s age, desired retirement lifestyle, risk tolerance, and time horizon. Financial advisors help their clients navigate retirement accounts such as 401(k)s and IRAs, as well as other investment options to build a retirement nest egg.

4. Tax Planning and Optimization: Financial advisors assist their clients with tax planning and optimization strategies. They help minimize tax liabilities and maximize savings by taking advantage of tax-efficient investment options and deductions. Financial advisors stay up-to-date with the latest tax laws and regulations, ensuring that their clients are in compliance and making the most of available tax benefits.

5. Estate Planning: Estate planning is an important consideration for individuals who want to protect and distribute their assets according to their wishes. Financial advisors work with their clients to develop comprehensive estate plans that include wills, trusts, and other legal documents. They help minimize estate taxes, ensure a smooth transfer of assets to beneficiaries, and provide guidance on charitable giving and legacy planning.

6. Risk Management and Insurance: Financial advisors help their clients assess and manage financial risks. They evaluate insurance needs and recommend appropriate coverage such as life insurance, disability insurance, and long-term care insurance. Financial advisors also help their clients understand the risks associated with different investment options and develop strategies to mitigate these risks.

In conclusion, financial advisors offer a range of services to help individuals and families manage their finances and achieve their financial goals. Whether it’s financial planning, investment management, retirement planning, tax optimization, estate planning, or risk management, a financial advisor can provide the expertise and guidance needed to succeed.

Financial Planning for Different Life Stages

Financial planning is a lifelong process that evolves as individuals and families progress through different life stages. Each stage brings unique financial challenges and opportunities, and it’s important to adjust financial strategies accordingly. Here’s a look at financial planning considerations for different life stages:

1. Young Adults: Young adults who are just starting their careers face several financial challenges. This includes managing student loans, establishing a budget, and building an emergency fund. Financial advisors can help young adults create a solid financial foundation by setting financial goals, developing a budget, and creating a plan to pay off debt. They can also provide guidance on saving for short-term goals such as buying a home or starting a family.

2. Newlyweds and Young Families: For newlyweds and young families, financial planning takes on added importance. Financial advisors can help couples merge their finances, establish joint goals, and create a plan to achieve these goals. This can include saving for a down payment on a home, creating an emergency fund, and starting to save for their children’s education. Financial advisors can also help young families with estate planning, ensuring that their assets are protected and distributed according to their wishes.

3. Mid-Career Professionals: Mid-career professionals face a different set of financial challenges. They may be juggling multiple financial goals such as saving for retirement, paying for their children’s education, and balancing their current lifestyle expenses. Financial advisors can help mid-career professionals prioritize their financial goals, develop a comprehensive financial plan, and make informed investment decisions. They can also provide guidance on tax optimization strategies and help professionals navigate career transitions or job changes.

4. Pre-Retirees: As individuals approach retirement, financial planning takes on a new level of importance. Financial advisors work with pre-retirees to assess their retirement goals, determine their retirement income needs, and create a plan to achieve these goals. This includes evaluating retirement accounts, Social Security benefits, and other sources of income. Financial advisors can also help pre-retirees develop strategies to minimize taxes during retirement and ensure that their assets are protected.

5. Retirees: Retirees have unique financial needs and considerations. Financial advisors can help retirees manage their retirement income, make withdrawals from retirement accounts, and create a plan to sustain their lifestyle throughout retirement. They can also provide guidance on healthcare expenses, long-term care planning, and estate planning. Financial advisors help retirees navigate the complex financial landscape and ensure that they have a solid plan in place to support them during their golden years.

In conclusion, financial planning is a dynamic process that evolves as individuals and families progress through different life stages. Whether you’re a young adult just starting your career or a retiree enjoying your golden years, a financial advisor can help you navigate the unique financial challenges and opportunities that each stage brings. By working with a financial advisor, you can ensure that your financial plan remains aligned with your goals and helps you achieve long-term financial success.

Investment Strategies and Portfolio Management

Investing is an essential component of any comprehensive financial plan. It allows individuals and families to grow their wealth and achieve their long-term financial goals. However, navigating the world of investments can be complex and overwhelming. That’s where a financial advisor comes in. They can provide expert guidance and help you develop an investment strategy that aligns with your goals and risk tolerance. Here are some investment strategies and portfolio management considerations:

1. Goal-Based Investing: Goal-based investing involves aligning your investment strategy with specific financial goals. This approach focuses on the time horizon and risk tolerance associated with each goal. For example, a long-term goal such as retirement may have a higher risk tolerance and a more aggressive investment strategy, while a short-term goal such as buying a house may have a lower risk tolerance and a more conservative strategy. Financial advisors can help you identify your goals, assess your risk tolerance, and develop an investment plan that supports these goals.

2. Asset Allocation: Asset allocation is the process of dividing your investment portfolio among different asset classes such as stocks, bonds, and cash. It involves balancing risk and reward based on your goals, time horizon, and risk tolerance. Financial advisors can help you determine the optimal asset allocation for your portfolio and make adjustments as needed. They consider factors such as market conditions, economic trends, and your risk tolerance to ensure that your portfolio is well-diversified and positioned for long-term growth.

3. Diversification: Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and geographic regions. By divers