Certified Financial Planner

A certified financial planner (CFP) is a professional who specializes in providing expert financial advice to individuals and businesses. These professionals have undergone rigorous training and have met the strict educational and ethical requirements set by the Certified Financial Planner Board of Standards (CFP Board). A CFP is equipped with the knowledge and expertise to help clients navigate the complexities of personal finance and make informed decisions.

A CFP goes beyond basic budgeting and investing. They take a holistic approach, understanding each client’s unique financial circumstances and goals. Whether it is retirement planning, tax optimization, insurance coverage, or estate planning, a CFP covers a wide range of financial aspects and provides personalized solutions tailored to each individual’s needs.

Having a CFP by your side can make a significant difference in achieving your financial goals. They have a deep understanding of the financial landscape and stay up-to-date with the latest industry trends and regulations. This ensures that clients receive the most accurate and current advice, allowing them to make informed decisions.

With a CFP, you can have peace of mind knowing that your financial well-being is in capable hands. These professionals are bound by a strict code of ethics and act in the best interest of their clients. They provide transparent and unbiased recommendations, ensuring that clients receive the guidance they need to secure their financial future.

Benefits of Hiring a Certified Financial Planner

Hiring a certified financial planner comes with numerous benefits that can significantly impact your financial well-being. Whether you are just starting your financial journey or have complex financial needs, a CFP can help you achieve your goals. Here are some key benefits of working with a CFP:

- Expertise and Knowledge: Certified financial planners have undergone extensive training and education to earn their certification. They possess a deep understanding of financial concepts, investment strategies, and tax regulations. Their expertise allows them to provide valuable insights and guidance tailored to your specific financial situation.

- Comprehensive Financial Planning: A CFP takes a holistic approach to financial planning. They assess your current financial status, evaluate your goals, and develop a personalized plan to help you achieve them. This includes budgeting, investment management, risk management, retirement planning, tax optimization, and more. By addressing all aspects of your finances, a CFP ensures that you have a comprehensive plan in place.

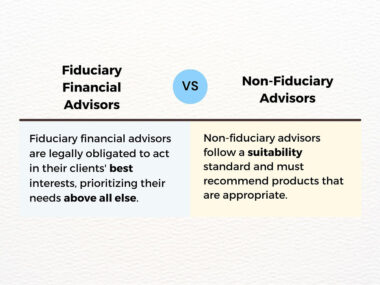

- Objectivity and Unbiased Advice: One of the greatest benefits of working with a CFP is their ability to provide objective and unbiased advice. They act as fiduciaries, meaning they are legally obligated to act in your best interest. This ensures that the recommendations they provide are not influenced by any conflicts of interest, allowing you to make decisions with confidence.

- Time and Stress Savings: Managing your finances can be time-consuming and overwhelming, especially if you have limited knowledge in this area. By hiring a CFP, you can offload the responsibility of financial management to an expert. This frees up your time and relieves the stress associated with making complex financial decisions.

- Long-Term Financial Security: A CFP helps you develop a long-term financial plan that aligns with your goals. They consider various factors such as your income, expenses, debts, and risk tolerance to create a roadmap for your financial future. With their guidance, you can make informed decisions that contribute to your long-term financial security.

- Adaptability to Life Changes: Life is full of unexpected events and changes. Whether it’s getting married, having children, changing careers, or planning for retirement, a CFP can help you navigate these transitions. They adjust your financial plan to accommodate new goals, challenges, and opportunities, ensuring that you stay on track regardless of the circumstances.

By hiring a certified financial planner, you gain access to a wealth of knowledge and expertise that can have a profound impact on your financial well-being. With their comprehensive approach, objectivity, and long-term perspective, a CFP becomes your trusted partner in achieving financial success.

How to Become a Certified Financial Planner

Becoming a certified financial planner (CFP) requires a combination of education, experience, and passing the CFP examination. The process is designed to ensure that individuals who hold the CFP designation possess the necessary knowledge and skills to provide competent financial planning advice. Here are the steps to become a CFP:

- Education: The first step towards becoming a CFP is completing the required educational coursework. This typically involves completing a bachelor’s degree or higher from an accredited institution. The coursework covers various topics related to financial planning, including investments, retirement planning, tax planning, risk management, and estate planning.

- Experience: In addition to education, aspiring CFPs must gain practical experience in the financial planning field. This involves accumulating at least 6,000 hours of professional experience related to financial planning or 4,000 hours of apprenticeship experience. The experience requirement ensures that CFP candidates have hands-on knowledge and understanding of financial planning concepts.

- CFP Examination: After meeting the education and experience requirements, candidates must pass the CFP examination, which is administered by the CFP Board. The examination consists of multiple-choice questions and case studies that assess the candidate’s understanding of financial planning principles, ethics, and practices. Passing the examination demonstrates the candidate’s competency in comprehensive financial planning.

- Ethics and Fitness: In addition to education and examination, candidates must adhere to the CFP Board’s ethics standards and demonstrate fitness to practice. This involves disclosing any criminal history, civil litigation, or disciplinary actions. The CFP Board thoroughly reviews the candidate’s background to ensure that they meet the ethical standards set by the profession.

- Continuing Education: Once certified, CFPs are required to maintain their knowledge and skills through ongoing professional development. This involves completing a certain number of continuing education hours each year to stay updated with the latest industry trends, regulations, and best practices. Continuing education ensures that CFPs provide clients with the most current and relevant advice.

Becoming a CFP requires dedication, commitment, and a passion for helping others achieve their financial goals. The process ensures that CFPs have the necessary education, experience, and ethical standards to provide competent and trustworthy financial planning advice.

The Role of a Certified Financial Planner

A certified financial planner (CFP) plays a crucial role in helping individuals and businesses achieve their financial goals. Their expertise and comprehensive approach to financial planning make them valuable partners in navigating the complexities of personal finance. Here are the key roles and responsibilities of a CFP:

- Assessing Financial Situation: A CFP begins by assessing a client’s current financial situation. This involves gathering information about income, expenses, assets, debts, and financial goals. By understanding these factors, a CFP can develop a personalized financial plan that aligns with the client’s objectives.

- Goal Setting: Once the financial situation is assessed, a CFP helps clients define their financial goals. These goals can range from short-term objectives like saving for a vacation to long-term goals like retirement planning. A CFP assists in setting realistic and achievable goals based on the client’s financial capacity and time horizon.

- Developing a Financial Plan: With the client’s goals in mind, a CFP develops a comprehensive financial plan. This plan takes into account various aspects of personal finance, including budgeting, investment management, risk management, retirement planning, tax optimization, and estate planning. The plan serves as a roadmap for the client’s financial journey.

- Implementing the Plan: Once the financial plan is developed, a CFP helps clients implement the recommended strategies. This may involve opening investment accounts, setting up retirement plans, purchasing insurance policies, or establishing estate plans. A CFP guides clients through the implementation process, ensuring that all necessary steps are taken.

- Monitoring and Reviewing: Financial planning is an ongoing process, and a CFP plays a vital role in monitoring and reviewing the client’s financial progress. They regularly review the client’s financial plan, investment performance, and changing circumstances to ensure that the plan remains relevant and effective. If necessary, adjustments are made to align the plan with new goals or changes in the financial landscape.

- Education and Guidance: A CFP educates clients about financial concepts, investment strategies, and risk management techniques. They provide guidance and answer questions to help clients make informed decisions about their finances. By empowering clients with knowledge, a CFP enables them to take an active role in their financial well-being.

- Behavioral Coaching: One of the unique roles of a CFP is behavioral coaching. They help clients overcome emotional biases and make rational financial decisions. By providing objective advice and reminding clients of their long-term goals, a CFP helps clients stay on track even during market volatility or financial uncertainties.

- Collaboration with Professionals: Financial planning often involves collaboration with other professionals, such as tax advisors, attorneys, and insurance agents. A CFP works closely with these professionals to ensure that all aspects of the client’s financial plan are coordinated and optimized. This collaborative approach ensures that clients receive comprehensive and integrated solutions.

A certified financial planner is a trusted advisor who guides clients through their financial journey. Their roles and responsibilities extend beyond basic financial advice, encompassing comprehensive planning, implementation, monitoring, and education. With their expertise, objectivity, and ongoing support, a CFP becomes an invaluable resource for individuals and businesses seeking financial security and prosperity.

Services Provided by Certified Financial Planners

Certified financial planners (CFPs) offer a wide range of services aimed at helping individuals and businesses achieve their financial goals. These services are designed to address various aspects of personal finance and provide tailored solutions to meet the unique needs of each client. Here are some of the key services provided by CFPs

- Financial Planning: Financial planning is at the core of a CFP’s services. They assess a client’s current financial situation, define their goals, and develop a comprehensive plan to achieve those goals. This includes budgeting, cash flow management, investment planning, risk management, retirement planning, tax optimization, and estate planning. A CFP considers all aspects of personal finance to create a holistic plan that aligns with the client’s objectives.

- Investment Management: CFPs provide expertise in investment management to help clients grow their wealth. They analyze clients’ risk tolerance, investment goals, and time horizon to develop a tailored investment strategy. This may involve asset allocation, diversification, and selecting suitable investment vehicles such as stocks, bonds, mutual funds, or exchange-traded funds (ETFs). A CFP regularly monitors and adjusts the investment portfolio to ensure it remains aligned with the client’s objectives.

- Retirement Planning: Planning for retirement is a crucial aspect of personal finance, and CFPs specialize in helping clients navigate this complex process. They assess the client’s retirement goals, estimate future income needs, and develop a comprehensive retirement plan. This may involve strategies such as maximizing contributions to retirement accounts, evaluating Social Security options, determining optimal withdrawal strategies, and incorporating tax-efficient retirement income sources.

- Risk Management: CFPs help clients protect their financial well-being by addressing various risks. This includes evaluating insurance needs such as life insurance, health insurance, disability insurance, and long-term care insurance. A CFP assesses the client’s risk tolerance and recommends appropriate insurance coverage to mitigate potential financial losses. They also assist in reviewing existing insurance policies to ensure they remain adequate and cost-effective.

- Tax Planning: CFPs provide guidance on tax planning strategies to minimize tax liabilities and maximize after-tax returns. They analyze the client’s income, investments, and deductions to identify tax-saving opportunities. This may involve strategies such as tax-efficient investment placement, retirement account contributions, charitable giving, and capital gains management. A CFP works in collaboration with tax professionals to ensure a coordinated approach to tax planning.

- Estate Planning: Estate planning is essential to ensure the smooth transfer of assets and wealth to future generations. CFPs help clients create a comprehensive estate plan that includes wills, trusts, powers of attorney, and healthcare directives. They consider the client’s wishes, family dynamics, and tax implications to develop an estate plan that aligns with their goals. A CFP regularly reviews and updates the estate plan to accommodate changes in the client’s circumstances or tax laws.

- Education and College Funding: CFPs assist clients in planning for education expenses, whether it’s saving for a child’s college education or pursuing further education themselves. They evaluate the client’s education goals, estimate future costs, and recommend appropriate savings strategies such as 529 college savings plans or education savings accounts (ESAs). A CFP helps clients navigate the complex landscape of financial aid options and scholarship opportunities.

- Business Financial Planning: CFPs provide financial planning services to businesses and entrepreneurs. They help with business planning, cash flow management, risk management, employee benefits, succession planning, and exit strategies. A CFP works closely with business owners to ensure that their personal and business finances are integrated and optimized for long-term success.

These are just a few examples of the services provided by certified financial planners. Each client’s financial needs are unique, and a CFP tailors their services to address those specific needs. By offering a comprehensive range of services, CFPs become trusted advisors who guide clients towards financial security and prosperity.

Common Misconceptions About Certified Financial Planners

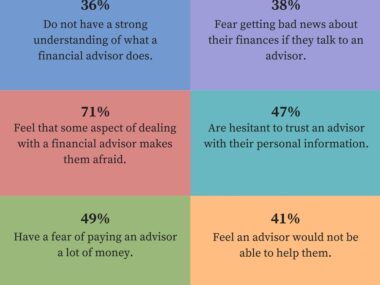

Certified financial planners (CFPs) play a crucial role in helping individuals and businesses achieve their financial goals. However, there are several common misconceptions about CFPs that can prevent people from seeking their guidance. Let’s debunk some of these misconceptions and shed light on the true value of working with a CFP:

- CFPs are only for the wealthy: One of the most common misconceptions is that CFPs are only for the wealthy. In reality, CFPs work with clients of all income levels and net worth. Whether you are just starting your financial journey or have complex financial needs, a CFP can provide valuable guidance tailored to your specific circumstances.

- CFPs are only for retirement planning: While retirement planning is an essential aspect of financial planning, CFPs offer a comprehensive range of services beyond retirement. They address various aspects of personal finance, including budgeting, investment management, risk management, tax planning, estate planning, education planning, and more. CFPs take a holistic approach to financial planning and provide guidance on all aspects of your financial well-being.

- CFPs only focus on investments: While investment management is a part of a CFP’s services, it is not their sole focus. CFPs