Can I Make Money as a Financial Planner

Thinking of a career as a financial planner? You’re not alone. Many individuals are drawn to this profession because of the potential to make money. But can you really make money as a financial planner? The short answer is yes, but it’s not as simple as it may seem.

The Role of a Financial Planner

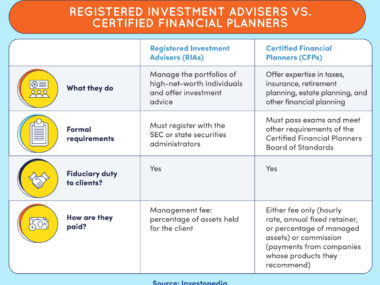

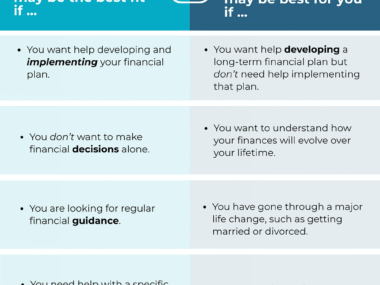

A financial planner is a professional who helps individuals and businesses manage their finances and achieve their financial goals. They provide advice on investments, retirement planning, tax strategies, and other areas of personal finance. Financial planners often work closely with their clients to create personalized financial plans and help them make informed decisions about their money.

Can You Make Money as a Financial Planner?

The answer to this question depends on several factors. While it is possible to make money as a financial planner, it’s important to understand that success in this field is not guaranteed. Like any other profession, it requires hard work, dedication, and a commitment to ongoing learning and professional development.

Financial planning is a highly competitive industry, and it can take time to build a client base and establish yourself as a trusted advisor. It’s also important to note that your income as a financial planner will vary depending on factors such as your location, experience, and the type of clients you serve.

The Earning Potential of a Financial Planner

According to the U.S. Bureau of Labor Statistics, the median annual wage for personal financial advisors was $87,850 in May 2020. However, it’s important to keep in mind that this is just a median figure, and the earning potential of a financial planner can be much higher.

Experienced financial planners who have built a successful practice and serve high-net-worth individuals can earn six-figure incomes or even more. The key to maximizing your earning potential as a financial planner is to provide exceptional service to your clients, continually expand your knowledge and skills, and stay up-to-date with the latest trends and developments in the financial industry.

Steps to Becoming a Successful Financial Planner

Becoming a successful financial planner requires a combination of education, experience, and personal qualities. Here are some steps you can take to start your journey:

- Obtain the necessary education: To become a financial planner, you’ll need a bachelor’s degree in finance, economics, or a related field. Some financial planners also pursue advanced degrees or certifications to enhance their knowledge and credentials.

- Gain relevant experience: Consider internships or entry-level positions in financial planning firms to gain practical experience and learn from experienced professionals. This will help you develop a deeper understanding of the industry and build a network of contacts.

- Obtain relevant certifications: Consider pursuing certifications such as the Certified Financial Planner (CFP) designation, which is widely recognized and respected in the industry. These certifications demonstrate your expertise and commitment to professional standards.

- Build a strong network: Networking is crucial in the financial planning industry. Attend industry conferences, join professional associations, and actively engage with other professionals in the field. Building relationships with other financial planners, accountants, lawyers, and other professionals can lead to referrals and new business opportunities.

- Continuously learn and adapt: The financial industry is constantly evolving, and it’s important to stay informed about new products, regulations, and market trends. Invest in your professional development by attending seminars, workshops, and webinars, and consider joining study groups or discussion forums to exchange ideas and learn from others.

Building a Client Base as a Financial Planner

Once you have the necessary qualifications and experience, the next step is to build a client base. Here are some strategies that can help you attract and retain clients:

- Define your target market: Determine the type of clients you want to serve and develop a deep understanding of their needs, goals, and concerns. This will allow you to tailor your services and marketing efforts to attract and retain your ideal clients.

- Leverage your network: Reach out to friends, family, former colleagues, and other contacts who may be potential clients or sources of referrals. Let them know about your services and how you can help them achieve their financial goals.

- Establish an online presence: Create a professional website and social media profiles to showcase your expertise and attract potential clients. Share valuable content, such as blog articles and videos, that demonstrate your knowledge and provide insights into financial planning topics.

- Offer free consultations: Consider offering free initial consultations to potential clients. This gives you an opportunity to showcase your expertise and build trust. If the client sees value in your services, they are more likely to become a paying client.

- Ask for referrals: Once you have established a client base, don’t be afraid to ask satisfied clients for referrals. Word-of-mouth recommendations can be a powerful marketing tool and can help you expand your client base.

Marketing Strategies for Financial Planners

In addition to building a client base, effective marketing is essential for the success of your financial planning practice. Here are some marketing strategies to consider:

- Develop a strong brand: Define your unique value proposition and create a brand that reflects your expertise, personality, and the type of clients you serve. Your brand should convey trust, professionalism, and a commitment to helping clients achieve their financial goals.

- Create compelling content: Develop a content marketing strategy that includes blog articles, videos, podcasts, and social media posts. Provide valuable and actionable information that educates and engages your target audience. This positions you as an authority in your field and helps attract potential clients.

- Utilize online advertising: Consider using online advertising platforms, such as Google Ads or social media ads, to reach a wider audience and generate leads. Target your ads to specific demographics and geographic locations to maximize their effectiveness.

- Attend industry events: Participate in industry conferences, seminars, and trade shows to network with potential clients and stay up-to-date with the latest trends and developments in the financial planning industry. Consider speaking at these events to establish yourself as a thought leader.

- Engage with the local community: Get involved in your local community by volunteering, sponsoring local events, or offering financial literacy workshops. This helps raise awareness of your services and builds trust with potential clients.

The Importance of Ongoing Education and Certifications

To stay competitive in the financial planning industry, it’s important to prioritize ongoing education and professional development. The financial industry is constantly evolving, and new regulations, products, and market trends can significantly impact your clients’ financial plans.

Continuing education programs, certifications, and professional associations provide opportunities to expand your knowledge, enhance your skills, and stay informed about industry best practices. They also demonstrate your commitment to maintaining the highest standards of professionalism and ethics.

Challenges and Pitfalls of Being a Financial Planner

While a career as a financial planner can be rewarding and lucrative, it’s not without its challenges and pitfalls. Here are some common challenges you may face:

- Client expectations: Clients often have high expectations for their financial planners and expect them to consistently deliver positive results. Managing these expectations and effectively communicating the risks associated with investments is crucial.

- Market volatility: Financial markets can be unpredictable, and economic downturns can significantly impact the value of investments. As a financial planner, you need to help your clients navigate these fluctuations and make informed decisions to protect and grow their wealth.

- Regulatory compliance: The financial planning industry is subject to strict regulations and compliance requirements. Staying up-to-date with these regulations and ensuring that your practice is in compliance can be time-consuming and challenging.

- Competition: The financial planning industry is highly competitive, and it can be challenging to differentiate yourself from other practitioners. Building a strong brand, providing exceptional service, and continuously improving your skills can help you stand out in a crowded market.

Conclusion

In conclusion, while it is possible to make money as a financial planner, success in this field requires more than just a desire to make money. It requires knowledge, expertise, and a deep understanding of financial markets and investments. Building a client base and establishing yourself as a trusted advisor is also crucial.

However, for those who are passionate about helping others achieve their financial goals and are willing to put in the work, a career as a financial planner can be a great opportunity to make money while making a difference. With the right qualifications, marketing strategies, and ongoing education, you can build a successful financial planning practice and enjoy a rewarding and lucrative career.