How To Make Six To Seven Figures As A Financial Advisor

Are you a financial advisor looking to take your career to the next level? Do you dream of earning six to seven figures and achieving unparalleled success in your field? If so, you’re in the right place. In this article, we will share the secrets to making six to seven figures as a financial advisor and provide you with actionable strategies to maximize your earnings.

The role of a financial advisor

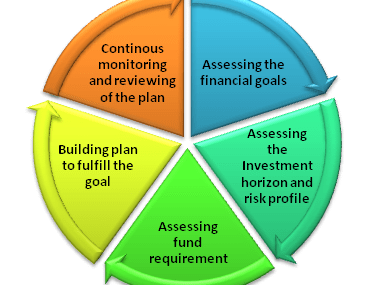

As a financial advisor, you play a crucial role in helping individuals and businesses make informed financial decisions. Your responsibilities include assessing clients’ financial goals, creating personalized investment plans, managing portfolios, and providing ongoing financial advice. However, being a financial advisor is about more than just numbers and investments. It’s about building trust, understanding clients’ needs, and guiding them towards a secure financial future.

To excel in your role, it’s essential to stay updated with the latest trends and developments in the financial industry. Continuous professional development through workshops, industry conferences, and certifications is key to enhancing your knowledge and expertise. By investing in your education, you can position yourself as a trusted advisor who offers valuable insights and guidance to clients.

Building a strong foundation: Education and certifications for financial advisors

To establish yourself as a credible financial advisor, it’s crucial to have a strong educational background. A bachelor’s degree in finance, economics, or a related field is typically the minimum requirement. However, to stand out in the competitive landscape, pursuing advanced degrees such as a Master’s in Business Administration (MBA) or obtaining specialized certifications can give you an edge.

Certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Certified Investment Management Analyst (CIMA) are highly regarded in the financial industry. These certifications demonstrate your expertise in financial planning, investment analysis, and portfolio management, making you a valuable asset to your clients.

Developing expertise and specialization: Areas of focus for financial advisors

While having a broad understanding of various financial areas is important, developing expertise and specialization in specific niches can significantly impact your earning potential. By focusing on a particular market segment or industry, you can position yourself as an expert and attract clients who require specialized advice.

Some areas of specialization for financial advisors include retirement planning, estate planning, tax planning, and investment strategies for specific industries such as healthcare or technology. By honing your skills in these areas, you can provide tailored solutions that cater to your clients’ unique needs, ultimately increasing your value as an advisor.

Building a client base: Strategies for attracting and retaining high-net-worth clients

Building a strong client base is crucial for financial advisors looking to make six to seven figures. However, attracting and retaining high-net-worth clients requires a combination of strategic marketing, exceptional client service, and building trust.

One effective strategy is to leverage digital marketing techniques to reach a wider audience. Establishing a strong online presence through a professional website, blog, and social media profiles can help you showcase your expertise and attract potential clients. Additionally, consider creating valuable content such as educational videos, webinars, and articles that demonstrate your knowledge and provide actionable insights.

Networking is another powerful tool for expanding your client base. Attend industry events, join professional organizations, and actively engage with other professionals in your field. By building relationships with attorneys, accountants, and other professionals who work closely with high-net-worth individuals, you can increase referrals and expand your reach.

Leveraging technology: Tools and platforms to streamline your financial advisory business

Technology has revolutionized the financial industry, and financial advisors can leverage various tools and platforms to streamline their business operations and enhance client experiences. Robo-advisors, for example, are automated investment platforms that use algorithms to create and manage portfolios. By incorporating robo-advisory services into your practice, you can efficiently serve clients with smaller investment amounts while focusing your time and expertise on high-net-worth individuals.

Client relationship management (CRM) software is another valuable tool for financial advisors. These platforms help you track client interactions, manage appointments, and automate workflows, allowing you to provide personalized and efficient service. By utilizing technology to automate routine tasks, you can free up more time to focus on building relationships and providing valuable advice to your clients.

Setting competitive fees: Pricing strategies for financial advisors

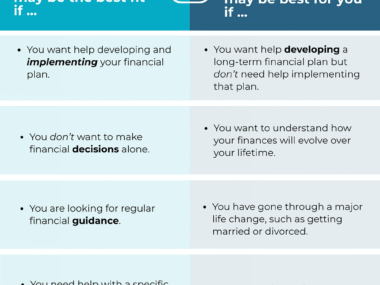

Determining the right fee structure is essential for financial advisors looking to maximize their earnings. While there is no one-size-fits-all approach, there are several pricing strategies you can consider.

One common approach is the assets under management (AUM) fee model, where you charge a percentage of the total assets you manage for your clients. This model aligns your interests with your clients’ as your income grows along with their investments. Another approach is the hourly fee model, where you charge clients based on the time spent on their financial planning and advisory services. This model is suitable for clients with specific short-term needs.

Alternatively, you can offer a retainer fee structure, where clients pay a fixed monthly or annual fee for ongoing financial advice and services. This model provides a predictable income stream and encourages long-term client relationships. Ultimately, the key is to find a pricing strategy that aligns with your target market, the value you provide, and your income goals.

Scaling your business: Strategies for growth and expansion

Once you have established a solid foundation and built a strong client base, scaling your financial advisory business becomes the next step towards achieving six to seven figures. Here are some strategies to consider:

- Hire and delegate: As your business grows, it becomes crucial to delegate non-client-facing tasks to support staff. Hiring additional advisors or administrative staff can help you focus on high-value activities such as client acquisition and relationship management.

- Automate processes: Technology can play a pivotal role in scaling your business. Look for opportunities to automate routine tasks, such as client onboarding, portfolio rebalancing, and reporting. This will allow you to serve more clients efficiently and free up time for strategic growth initiatives.

- Expand your service offerings: Consider diversifying your revenue streams by offering additional services such as financial planning workshops, educational webinars, or specialized consulting services. This allows you to tap into different market segments and attract clients with varying needs.

Networking and collaboration: Building relationships with other professionals in the industry

Building a strong network of professionals in the financial industry is invaluable for financial advisors. Collaborating with attorneys, accountants, insurance agents, and other professionals can not only enhance the value you provide to your clients but also open doors to new opportunities.

Attend industry conferences, join networking groups, and actively engage in online communities to connect with like-minded professionals. By building relationships based on trust and mutual support, you can create a network of referral partners who can help grow your business.

Conclusion: The key to success as a financial advisor and the potential for significant earnings

Becoming a successful financial advisor and earning six to seven figures requires a combination of knowledge, expertise, strategic marketing, exceptional client service, and continuous professional development. By understanding your responsibilities, investing in education and certifications, specializing in specific niches, attracting high-net-worth clients, leveraging technology, setting competitive fees, scaling your business, and building a strong network, you can unlock your full potential and achieve unparalleled success in your field.

Remember, success as a financial advisor is not solely measured by your income but by the positive impact you have on your clients’ lives. By providing sound financial advice, guiding clients towards their goals, and helping them achieve financial freedom, you can build a rewarding and prosperous career as a financial advisor. So, take action today, embrace the strategies shared in this article, and pave your way to six to seven figures as a financial advisor. Your dream of financial success awaits!