Whether you’re in Nigeria navigating the rising cost of living, in the USA dealing with inflation and student loans, or anywhere else in the world trying to build financial security, mastering your personal finances has never been more important. The best personal finance tips can help you stay in control, reach your goals faster, and avoid financial stress. In this guide, you’ll learn practical, time-tested strategies that work—no matter where you live.

SEE ALSO The Best Remote Jobs for Writers in 2025

Build a Strong Financial Foundation

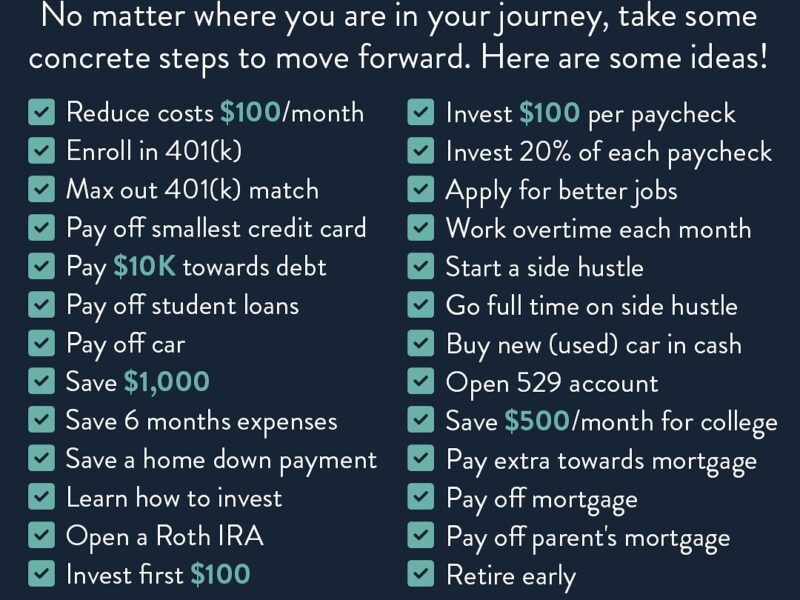

1. Set Clear Financial Goals

- Define short-term, medium-term, and long-term goals

- Examples: saving for a car, paying off student debt, buying a home

2. Track Your Income and Expenses

- Use apps like Mint, YNAB, or Nigerian alternatives like Cowrywise

- Understand where your money is going monthly

3. Create and Stick to a Monthly Budget

- Use the 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt repayment

- Adjust based on local cost of living

4. Build an Emergency Fund

- Aim for 3–6 months of essential expenses

- Start small: even $10 or ₦10,000 monthly counts

5. Separate Needs from Wants

- Avoid impulse spending

- Prioritize based on your goals, not peer pressure

Maximize Savings and Income

6. Automate Your Savings

- Set up auto-debits to savings accounts

- Helps you save without thinking

7. Open High-Yield Savings Accounts

- In the US: Ally, Marcus, or Discover

- In Nigeria: PiggyVest, Cowrywise, or Opay Save

8. Cut Unnecessary Expenses

- Cancel unused subscriptions

- Shop smart using coupons and price comparisons

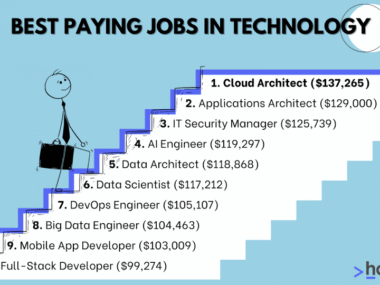

9. Increase Your Income Streams

- Start a side hustle: freelancing, dropshipping, content creation

- Consider remote jobs if you’re in Nigeria looking for dollar earnings

10. Review Subscriptions and Bills Regularly

- Negotiate or downgrade services you don’t use

- Switch to cost-effective alternatives

Manage Debt Wisely

11. Know Your Debt Types

- Good debt: mortgages, education loans

- Bad debt: credit card balances, payday loans

12. Use the Debt Snowball or Avalanche Method

- Snowball: pay smallest debt first

- Avalanche: pay highest interest rate first

13. Avoid Predatory Lending

- Stay away from high-interest payday lenders, especially common in Nigeria

- Use regulated financial institutions

14. Refinance or Consolidate Debt If Possible

- Seek better interest rates or combine loans into one

Smart Investing Tips for Beginners

15. Start Investing Early

- Time is your best friend when compounding

- Even small amounts matter

16. Diversify Your Investments

- Don’t put all your money in one basket

- Include stocks, bonds, real estate, and mutual funds

17. Use Investment Platforms

- US: Vanguard, Fidelity, Robinhood

- Nigeria: Bamboo, Chaka, Risevest

18. Avoid Get-Rich-Quick Schemes

- If it sounds too good to be true, it probably is

- Do thorough research before investing

Plan for the Long-Term

19. Save for Retirement

- US: 401(k), IRA

- Nigeria: Voluntary pension contributions, mutual funds

20. Get Health and Life Insurance

- Avoid financial disasters from medical emergencies

- Compare policies and choose wisely

21. Create a Will or Estate Plan

- Important even if you’re young

- Ensures your assets go to the right people

Boost Your Financial Literacy

22. Read Personal Finance Books and Blogs

- Popular options: Rich Dad Poor Dad, The Richest Man in Babylon

- Follow trusted local and international blogs

23. Watch YouTube Channels and Podcasts

- Great for visual/audio learners

- Some channels focus on Nigeria-specific advice

24. Take Online Courses

- Platforms like Coursera, Udemy, or Selar for Nigerian educators

- Some are free or affordable

Build Financial Discipline

25. Practice Delayed Gratification

- Don’t buy on impulse

- Wait 24 hours before big purchases

FAQs: Best Personal Finance Tips

Q: What’s the most important personal finance tip?

A: Always spend less than you earn and invest the difference. It’s the foundation of financial freedom.

Q: How can I manage personal finances on a low income?

A: Start by tracking expenses, eliminating non-essentials, and saving even the smallest amount consistently.

Q: Are budgeting apps safe to use in Nigeria and the USA?

A: Yes, but always use trusted apps with good reviews and security features like encryption.

Final Thoughts: Take Action Today

Personal finance is not about being perfect—it’s about being consistent. Start with one or two of these best personal finance tips, and gradually implement more as you go. Whether you’re in Nigeria, the USA, or anywhere else, the principles remain the same: earn smart, spend wisely, save consistently, and invest for the future.

Call-to-Action

Ready to take control of your financial future? Bookmark this post and start applying at least three of these tips today. Share this guide with a friend who needs it—and don’t forget to subscribe to our newsletter for weekly personal finance insights tailored to your region.