What Are the Benefits of an LLC?

Considering starting your own business? Choosing the right legal structure is a critical decision. One option that stands out is the Limited Liability Company (LLC). In this article, we will take you through the benefits of LLC.

Limited Liability Protection

When you form an LLC, your personal assets are protected from the company’s debts and legal liabilities. This means your personal savings and property are safeguarded, providing you with peace of mind.

An LLC is a separate legal entity, which means that it is responsible for its own debts and obligations. If the business fails or faces legal action, your personal assets, such as your home or car, cannot be used to satisfy these obligations. This separation between personal and business assets is one of the key benefits of forming an LLC.

Moreover, LLC owners are not personally liable for the actions or negligence of the company or its employees. This means that if the LLC is sued, the owners’ personal assets are generally protected, unless they personally guarantee a loan or engage in fraudulent or illegal activities. This limited liability protection is a significant advantage for small business owners seeking to protect their personal wealth.

In summary, forming an LLC provides personal liability protection by separating personal and business assets, shielding your personal savings and property from the company’s debts and legal liabilities.

Flexibility in Management and Ownership

One of the advantages of an LLC is its flexibility in management and ownership. Unlike other legal structures, such as corporations, an LLC does not have strict requirements for management and ownership.

In an LLC, the owners are referred to as members, and they have the freedom to choose how the company is managed. They can either manage the LLC themselves or appoint a manager to handle day-to-day operations. This flexibility allows members to structure the management of the company in a way that best suits their needs and expertise.

Additionally, an LLC allows for unlimited ownership, which means that there can be an unlimited number of members. This flexibility makes it easier to bring in new partners or investors as the business grows. It also provides an opportunity for family members or friends to join the company as members without the need for complex ownership structures.

In conclusion, an LLC provides flexibility in management and ownership, allowing members to choose how the company is managed and offering unlimited ownership opportunities.

Tax Advantages of an LLC

Another significant benefit of an LLC is its tax advantages. Unlike corporations, which are subject to double taxation, an LLC is a pass-through entity for tax purposes.

Pass-through taxation means that the business itself does not pay taxes. Instead, profits and losses flow through to the individual owners, who report them on their personal tax returns. This avoids the double taxation that corporations may experience, where the company pays taxes on its profits, and then shareholders pay taxes on the dividends received.

In addition to avoiding double taxation, an LLC also allows for more flexibility in tax planning. Members can choose to be taxed as a partnership, where each member reports their share of the profits and losses on their individual tax returns. Alternatively, an LLC can elect to be taxed as an S corporation, which may offer additional tax benefits.

It is important to note that the tax advantages of an LLC vary depending on the jurisdiction and the specific circumstances of the business. Consulting with a tax professional is recommended to fully understand the tax implications of forming an LLC.

In summary, an LLC’s pass-through taxation structure and flexibility in tax planning provide significant tax advantages compared to corporations, making it an attractive choice for business owners.

Enhanced Credibility and Professionalism

Forming an LLC can also enhance the credibility and professionalism of your business. When you operate as an LLC, it demonstrates to clients, customers, and potential investors that you have taken the necessary steps to establish a legitimate and legally compliant business.

The “LLC” designation after your business name adds a level of professionalism and credibility that can help you stand out from competitors who operate as sole proprietors or partnerships. It signals that your business is a separate legal entity, which can instill confidence and trust in your stakeholders.

Furthermore, many states require LLCs to file annual reports, maintain operating agreements, and comply with other formalities. These requirements can help establish a professional image for your business and demonstrate your commitment to transparency and good governance.

In conclusion, forming an LLC can enhance the credibility and professionalism of your business, providing a competitive advantage in the marketplace.

Privacy Protection

Privacy protection is another benefit of forming an LLC. When you register an LLC, you are required to provide certain information to the state, such as the names and addresses of the members or managers. However, this information is generally not publicly available.

Unlike sole proprietorships or general partnerships, where the owners’ personal information is often accessible through public records, an LLC offers a higher level of privacy. The public can only access limited information about the LLC, such as its name and registered agent.

This privacy protection can be particularly valuable for entrepreneurs who wish to keep their personal information separate from their business operations, maintain confidentiality, or minimize the risk of identity theft.

In summary, forming an LLC provides privacy protection by limiting the public disclosure of personal information associated with the business.

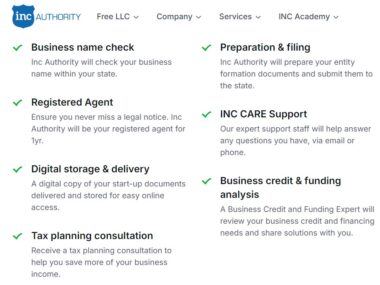

Easy Formation and Maintenance

One of the key advantages of an LLC is its ease of formation and maintenance. Compared to other legal structures, such as corporations, forming an LLC requires less paperwork and formalities.

To form an LLC, you typically need to file articles of organization with the appropriate state agency and pay the associated filing fees. The requirements for forming an LLC vary by state, but the process is generally straightforward and can be completed relatively quickly.

Once your LLC is formed, the ongoing maintenance requirements are also typically less burdensome compared to corporations. While it is important to comply with any state-specific requirements, such as filing annual reports or maintaining operating agreements, the administrative burden is generally lower for LLCs.

This ease of formation and maintenance allows business owners to focus more of their time and resources on growing their business, rather than dealing with complex legal and administrative tasks.

In conclusion, an LLC offers easy formation and maintenance, allowing entrepreneurs to establish their business efficiently and minimize administrative burdens.

Disadvantages of an LLC

While there are many benefits of forming an LLC, it is important to consider the potential disadvantages as well. Some of the drawbacks of an LLC include:

- Self-Employment Taxes: Unlike corporations, LLC members are typically subject to self-employment taxes, which can result in higher tax liability.

- Limited Life: In some states, an LLC has a limited life, meaning that it may dissolve upon the death or withdrawal of a member. However, this can be mitigated by including provisions in the operating agreement to address continuity.

- State-Specific Requirements: Each state has its own laws and regulations regarding LLCs, and compliance with these requirements can be complex and time-consuming.

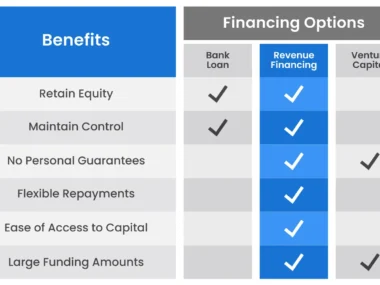

- Limited Access to Capital: Compared to corporations, LLCs may face challenges in raising capital through the issuance of stock or attracting investors due to the limited ownership structure.

- Less Established Legal Precedent: As a relatively newer legal entity, LLCs may have less established legal precedent compared to corporations, which could potentially lead to uncertainty in certain legal matters.

It is important to carefully weigh these disadvantages against the benefits of an LLC when deciding on the most appropriate legal structure for your business.

How to Form an LLC

Forming an LLC involves several steps. While the specific requirements may vary by state, the general process includes the following:

- Choose a Name: Select a unique and distinguishable name for your LLC that complies with state naming requirements.

- File Articles of Organization: Prepare and file the articles of organization with the appropriate state agency, providing the necessary information about your LLC.

- Designate a Registered Agent: Appoint a registered agent who will receive legal and official correspondence on behalf of the LLC.

- Create an Operating Agreement: Draft an operating agreement that outlines the rights and responsibilities of the LLC members, as well as the internal governance structure.

- Obtain Required Permits and Licenses: Identify and obtain any necessary permits or licenses required to operate your business legally.

- Comply with Ongoing Requirements: Stay informed about and comply with any ongoing reporting and tax obligations, such as filing annual reports or paying state fees.

It is advisable to consult with a legal and tax professional to ensure compliance with all state-specific requirements and to obtain personalized guidance throughout the formation process.

In conclusion, forming an LLC involves several steps, including choosing a name, filing articles of organization, designating a registered agent, creating an operating agreement, obtaining permits and licenses, and complying with ongoing requirements.

Conclusion

In conclusion, forming an LLC has numerous benefits that make it an appealing choice for business owners. The combination of personal liability protection, pass-through taxation, flexibility in management and ownership, enhanced credibility and professionalism, privacy protection, easy formation and maintenance, and other advantages make it a versatile and advantageous legal structure for entrepreneurs looking to establish their own business.

However, it is important to carefully consider the specific needs and circumstances of your business before deciding on the most appropriate legal structure. Consulting with legal, tax, and business professionals can provide valuable guidance and ensure that you make an informed decision that aligns with your goals.

By understanding the benefits and potential drawbacks of an LLC, you can make an informed choice that sets the foundation for a successful and legally compliant business venture.