What are the Top 5 Best Paying Related Financial Advisor Jobs in USA

Are you seeking a high-paying career in the financial sector? Look no further than the realm of financial advising. With its strong growth trajectory, this field promises lucrative opportunities for those seeking to secure their financial future. In this article, we will explore the top five best-paying related financial advisor jobs in the USA.

From the exhilarating world of investment banking to the stability of a corporate finance role, we will delve into each of these positions, providing insights into their average salaries, job outlook, and required qualifications. Whether you are an aspiring financial advisor or looking to make a career transition, this guide will equip you with the knowledge you need to make an informed decision.

With the financial industry constantly evolving, it’s important to stay ahead of the game and position yourself for success. Join us as we uncover the top financial advisor jobs that offer both financial security and professional fulfillment. Don’t miss out on this opportunity to explore the best-paying pathways in the ever-expanding landscape of finance.

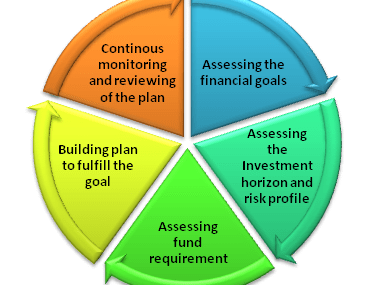

Factors that determine the pay of financial advisor jobs

The pay of financial advisor jobs can vary significantly depending on several factors. One of the primary factors is the level of experience and expertise. As a financial advisor gains more experience and builds a track record of success, they become more valuable to clients and are able to command higher fees. Additionally, the location of the job can also impact the pay. Financial advisors working in major cities, where the cost of living is higher, tend to earn more than those in smaller towns. The type of clients and industries served can also influence the pay scale. Financial advisors working with high net worth individuals or in specialized industries often earn higher salaries. Lastly, certifications and advanced degrees can increase earning potential as they demonstrate a higher level of expertise and credibility. These factors combined play a crucial role in determining the pay of financial advisor jobs.

The top 5 highest paying financial advisor jobs in the USA

Investment Banker

Investment bankers play a critical role in the financial industry, helping companies raise capital, advising on mergers and acquisitions, and providing strategic financial advice. With their expertise in analyzing market trends and assessing risk, investment bankers are highly sought after and well-compensated. The average salary for an investment banker in the USA ranges from $100,000 to $300,000, with top performers earning well into the six-figure range. To excel in this role, strong analytical skills, a deep understanding of financial markets, and the ability to thrive in a fast-paced environment are essential.

Corporate Finance Manager

Corporate finance managers are responsible for managing the financial activities of an organization, including budgeting, financial analysis, and strategic planning. They work closely with executives to ensure the financial health and growth of the company. Given the level of responsibility and the impact their decisions have on the organization, corporate finance managers are highly compensated. The average salary for a corporate finance manager in the USA ranges from $90,000 to $150,000, with additional bonuses and incentives often available. To succeed in this role, strong financial acumen, leadership skills, and the ability to make sound financial decisions are crucial.

Wealth Manager

Wealth managers work with high net worth individuals and families to help them grow and protect their wealth. They provide comprehensive financial planning, investment management, and estate planning services. Given the complex nature of their work and the level of trust required, wealth managers often command high salaries. The average salary for a wealth manager in the USA ranges from $80,000 to $150,000, with additional bonuses and commissions based on the performance of the assets under management. To thrive in this role, excellent interpersonal skills, a deep understanding of financial markets, and the ability to build and maintain client relationships are essential.

Financial Risk Manager

Financial risk managers are responsible for identifying and mitigating potential risks that could impact an organization’s financial stability. They analyze market trends, assess potential threats, and develop strategies to minimize risk exposure. Given the critical nature of their work and the demand for their expertise, financial risk managers are well-compensated. The average salary for a financial risk manager in the USA ranges from $80,000 to $140,000, with additional bonuses and incentives often available. To excel in this role, strong analytical skills, attention to detail, and the ability to think strategically are crucial.

Private Equity Analyst

Private equity analysts evaluate potential investment opportunities, conduct due diligence, and assist in the decision-making process for private equity firms. They analyze financial statements, assess market trends, and identify potential risks and opportunities. Private equity analysts are highly valued for their ability to identify lucrative investment opportunities and drive growth. The average salary for a private equity analyst in the USA ranges from $70,000 to $120,000, with additional bonuses and carried interest often available. To succeed in this role, strong financial analysis skills, attention to detail, and the ability to work in a fast-paced environment are essential.

Job responsibilities and qualifications for each high paying financial advisor job

Investment Banker

Job responsibilities: – Providing financial advice to clients regarding mergers and acquisitions, capital raising, and strategic financial decisions. – Conducting financial analysis and due diligence to assess investment opportunities. – Developing and maintaining relationships with clients and industry professionals. Qualifications: – Bachelor’s degree in finance, economics, or a related field. – Strong analytical and quantitative skills. – Excellent communication and presentation skills. – Ability to work in a high-pressure, fast-paced environment.

Corporate Finance Manager

Job responsibilities: – Overseeing the financial planning and analysis of the organization. – Developing and implementing financial strategies and policies. – Collaborating with executives to drive financial performance and growth. Qualifications: – Bachelor’s degree in finance, accounting, or a related field. – Strong financial analysis and modeling skills. – Leadership and strategic thinking abilities. – Excellent problem-solving and decision-making skills.

Wealth Manager

Job responsibilities: – Providing comprehensive financial planning and investment management services to high net worth individuals and families. – Developing and implementing investment strategies based on clients’ financial goals and risk tolerance. – Building and maintaining client relationships. Qualifications: – Bachelor’s degree in finance, economics, or a related field. – Certified Financial Planner (CFP) designation or similar certification. – Excellent interpersonal and relationship-building skills. – Strong knowledge of investment products and financial planning strategies.

Financial Risk Manager

Job responsibilities: – Identifying and assessing potential risks that could impact an organization’s financial stability. – Developing risk management strategies and policies. – Monitoring and reporting on risk exposures. Qualifications: – Bachelor’s degree in finance, risk management, or a related field. – Professional certification such as Certified Financial Risk Manager (FRM) or similar. – Strong analytical and problem-solving skills. – Attention to detail and ability to think strategically.

Private Equity Analyst

Job responsibilities: – Conducting financial analysis and due diligence on potential investment opportunities. – Developing investment theses and investment memos. – Assisting in the decision-making process for potential investments. Qualifications: – Bachelor’s degree in finance, accounting, or a related field. – Strong financial analysis and modeling skills. – Attention to detail and ability to work with large datasets. – Ability to work in a fast-paced, team-oriented environment.

Opportunities for growth and advancement in each financial advisor job

Each of the high-paying financial advisor jobs mentioned above offers ample opportunities for growth and advancement. As financial advisors gain experience and prove their value, they can progress to more senior roles within their respective fields. In investment banking, for example, analysts can progress to become associates, vice presidents, and ultimately managing directors. Similarly, corporate finance managers can advance to become finance directors or CFOs. Wealth managers can build their own client base and start their own wealth management firms. Financial risk managers can become risk directors or chief risk officers. Private equity analysts can advance to become senior associates, principals, and partners. The opportunities for growth are vast, and with dedication and continuous learning, financial advisors can carve out successful and rewarding careers in their chosen fields.

Average salary ranges for each high paying financial advisor job

The average salary ranges for each high-paying financial advisor job mentioned earlier are as follows:

- Investment Banker: $100,000 to $300,000

- Corporate Finance Manager: $90,000 to $150,000

- Wealth Manager: $80,000 to $150,000

- Financial Risk Manager: $80,000 to $140,000

- Private Equity Analyst: $70,000 to $120,000

It’s important to note that these salary ranges are approximate and can vary depending on factors such as location, experience, qualifications, and the size and reputation of the employer.

How to become a financial advisor and get started in the industry

To become a financial advisor, there are several steps you can take to get started in the industry:

- Obtain a relevant degree: A bachelor’s degree in finance, economics, accounting, or a related field is typically required to become a financial advisor. Some positions may require advanced degrees such as an MBA or a Master’s in Finance.

- Gain relevant work experience: Entry-level positions in financial advisory firms, banks, or investment companies can provide valuable experience and exposure to the industry. Internships and apprenticeships can also be beneficial in building your skills and network.

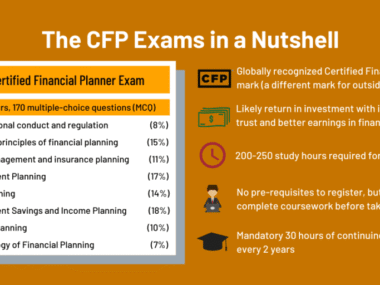

- Obtain certifications: Earning professional certifications such as the Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Financial Risk Manager (FRM) can enhance your credibility and increase your earning potential.

- Build a strong network: Networking is crucial in the financial advisory industry. Attend industry events, join professional associations, and connect with professionals in the field to expand your network and open doors to opportunities.

- Continuously learn and stay updated: The financial industry is constantly evolving, so it’s important to stay updated on the latest trends, regulations, and best practices. Continuous learning through professional development courses, workshops, and industry publications can help you stay ahead of the curve.

By following these steps and staying committed to your professional growth, you can position yourself for success as a financial advisor.

Skills and certifications that can increase earning potential in financial advisor jobs

In addition to the qualifications mentioned earlier, there are certain skills and certifications that can significantly increase your earning potential as a financial advisor:

- Strong analytical skills: The ability to analyze complex financial data, assess risk, and make informed decisions is highly valued in the financial advisory industry. Developing strong analytical skills can set you apart from the competition and open doors to higher-paying roles.

- Excellent communication skills: Effective communication is essential in building relationships with clients, understanding their financial goals, and explaining complex financial concepts. Strong communication skills can help you establish trust and credibility, leading to higher compensation.

- Advanced certifications: Earning advanced certifications such as the Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Financial Risk Manager (FRM) can demonstrate a higher level of expertise and credibility, increasing your earning potential.

- Business development skills: The ability to attract and retain clients is crucial in the financial advisory industry. Developing strong business development skills, such as networking, prospecting, and relationship-building, can lead to a larger client base and higher earnings.

- Continuous learning: The financial industry is dynamic, and staying updated on the latest trends, regulations, and best practices is crucial. Continuously investing in your professional development through courses, workshops, and certifications can enhance your skills and increase your earning potential.

By developing these skills and earning relevant certifications, you can position yourself as a highly skilled and sought-after financial advisor, increasing your earning potential in the process.

Tips for finding and landing high-paying financial advisor jobs

Finding and landing high-paying financial advisor jobs requires a strategic approach and careful planning. Here are some tips to help you in your job search

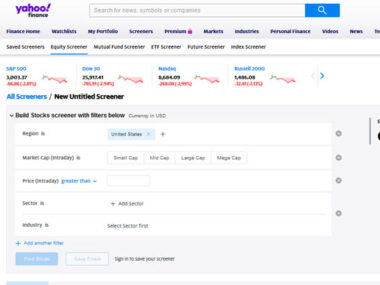

- Research the market: Conduct thorough research on the financial advisory industry, including the latest trends, salary ranges, and in-demand skills. This will help you identify the most lucrative job opportunities and tailor your job search accordingly.

- Build a strong network: Networking is crucial in the financial advisory industry. Connect with professionals in the field, attend industry events, and join relevant professional associations to expand your network. Networking can lead to valuable connections and job opportunities.

- Tailor your resume and cover letter: Customize your resume and cover letter to highlight your relevant skills, qualifications, and experience. Tailoring your application materials to each specific job opportunity can increase your chances of getting noticed by hiring managers.

- Prepare for interviews: Research the company and the role you are applying for, and prepare thoughtful questions to ask during the interview. Practice answering common interview questions and emphasize your relevant skills and experience.

- Showcase your value proposition: During interviews, emphasize how your skills, qualifications, and experience make you uniquely qualified for the role. Highlight your track record of success and how you can contribute to the company’s growth and success.

- Follow up after interviews: Send a thank-you note or email to the hiring manager after each interview to express your appreciation for their time and reiterate your interest in the position. Following up shows professionalism and can help you stand out from other candidates.

By following these tips and approaching your job search strategically, you can increase your chances of finding and landing high-paying financial advisor jobs.

Conclusion and final thoughts

The field of financial advising offers a wealth of opportunities for those seeking high-paying careers in the financial sector. From investment banking to corporate finance, wealth management to financial risk management, and private equity analysis, these roles promise both financial security and professional fulfillment. By understanding the factors that determine the pay of financial advisor jobs, exploring the top high-paying roles, and equipping yourself with the necessary qualifications and skills, you can position yourself for success in this dynamic and rewarding industry.

Remember, success in the financial advisory industry requires continuous learning, dedication, and a commitment to professional growth. Stay ahead of the game, adapt to industry trends, and always strive to deliver exceptional value to your clients. With the right skills, qualifications, and mindset, you can forge a successful and lucrative career as a financial advisor in the USA.