What Does a Financial Planner Do?

Are you unsure about what a financial planner does? Don’t worry, you’re not alone. Many people find the world of finance overwhelming and confusing. But fear not, because in this article, we will demystify the role of a financial planner, breaking it down into simple terms.

The Role of a Financial Planner

Simply put, a financial planner is a professional who helps individuals and families navigate their financial goals and make informed decisions about their money. They take into account factors like income, expenses, assets, and liabilities to create personalized financial plans tailored to each client’s unique circumstances.

A financial planner is like a guide who helps you map out your financial journey. They analyze your current financial situation and understand your future objectives to offer guidance on various aspects of your financial life. This can include retirement planning, investment strategies, tax optimization, and risk management.

A financial planner serves as a trusted partner, providing expertise and recommendations to help you achieve your financial goals. By leveraging their knowledge and expertise, they can guide you through the complexities of finance, helping you make smart choices and take control of your financial future.

Key Responsibilities of a Financial Planner

The responsibilities of a financial planner are extensive and cover various areas of personal finance. Let’s take a closer look at some of the key responsibilities they undertake.

- Assessing and Analyzing: A financial planner begins by assessing your current financial situation. They gather information about your income, expenses, assets, and liabilities to understand your financial health. This analysis helps them identify areas of improvement and areas where you can optimize your finances.

- Goal Setting: Once they have a clear picture of your financial situation, a financial planner helps you set realistic and achievable financial goals. These goals can vary from person to person and may include saving for retirement, buying a house, or funding your children’s education. By setting clear goals, you can have a roadmap to follow and measure your progress.

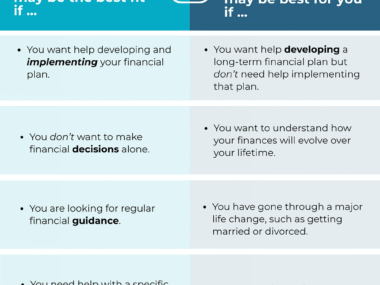

- Creating a Financial Plan: Based on your goals, a financial planner creates a comprehensive financial plan tailored to your specific needs. This plan outlines the steps you need to take to achieve your goals, including savings targets, investment strategies, and debt management plans. The plan also takes into account your risk tolerance and time horizon.

- Implementing the Plan: Once the financial plan is finalized, a financial planner helps you implement it. This may involve opening investment accounts, setting up automatic contributions, and making necessary adjustments to your budget. They guide you through the process, ensuring that you stay on track towards your financial goals.

- Monitoring and Rebalancing: Financial planning is an ongoing process, and a good financial planner will regularly monitor your progress. They review your investments, track your expenses, and assess any changes in your life circumstances. If needed, they will recommend adjustments to your financial plan to ensure it remains aligned with your goals.

Benefits of Hiring a Financial Planner

Now that we understand what a financial planner does and their key responsibilities, let’s explore the benefits of hiring one.

- Expertise and Knowledge: Financial planners are highly skilled professionals who have in-depth knowledge of personal finance. They stay up-to-date with the latest market trends, investment strategies, and tax regulations. By leveraging their expertise, you can make informed decisions about your money and take advantage of opportunities that you may not have been aware of.

- Objective Advice: When it comes to our own finances, emotions can often cloud our judgment. A financial planner provides objective advice, free from any emotional biases. They can help you see the bigger picture and make rational decisions based on your financial goals.

- Time and Effort Savings: Managing your finances can be time-consuming and overwhelming, especially if you have a complex financial situation. A financial planner takes this burden off your shoulders, allowing you to focus on other aspects of your life. With their guidance, you can save time and effort while still making progress towards your financial goals.

- Risk Management: Financial planners help you manage and mitigate financial risks. They assess your risk tolerance and recommend appropriate investment strategies that align with your goals. By diversifying your investments and staying informed about market trends, they can help you navigate potential risks and protect your wealth.

- Long-Term Planning: Financial planning is not just about short-term gains; it’s about long-term financial security. A financial planner helps you create a roadmap for your future, ensuring that you have a solid foundation for retirement and other long-term goals. They help you make informed decisions today that will benefit you in the years to come.

Steps to Becoming a Financial Planner

If you’re intrigued by the role of a financial planner and considering a career in this field, here are the steps to get started.

- Education and Qualifications: A bachelor’s degree in finance, economics, or a related field is a good starting point. Some financial planners pursue advanced degrees, such as a Master’s in Financial Planning or an MBA. Additionally, obtaining industry certifications, such as the Certified Financial Planner (CFP) designation, can enhance your credibility and job prospects.

- Gain Experience: After completing your education, gaining practical experience is crucial. Many aspiring financial planners start by working for financial planning firms or wealth management companies. This allows them to learn from experienced professionals and gain hands-on experience in various aspects of financial planning.

- Continuing Education: The financial planning industry is constantly evolving, with new regulations, investment strategies, and technologies. To stay relevant and maintain your professional standing, it’s important to engage in continuing education. This can include attending seminars, webinars, and workshops, as well as pursuing advanced certifications.

- Build a Network: Networking is key in the financial planning industry. Building relationships with other professionals, such as accountants, lawyers, and estate planners, can help you provide comprehensive financial solutions to your clients. Joining industry associations and attending conferences is a great way to expand your network.

- Obtain Licensing: Depending on the services you offer, you may need to obtain licenses to operate as a financial planner. This can include licenses for securities, insurance, and other regulated financial products. Ensure you understand the licensing requirements in your jurisdiction and obtain the necessary certifications.

Common Misconceptions About Financial Planners

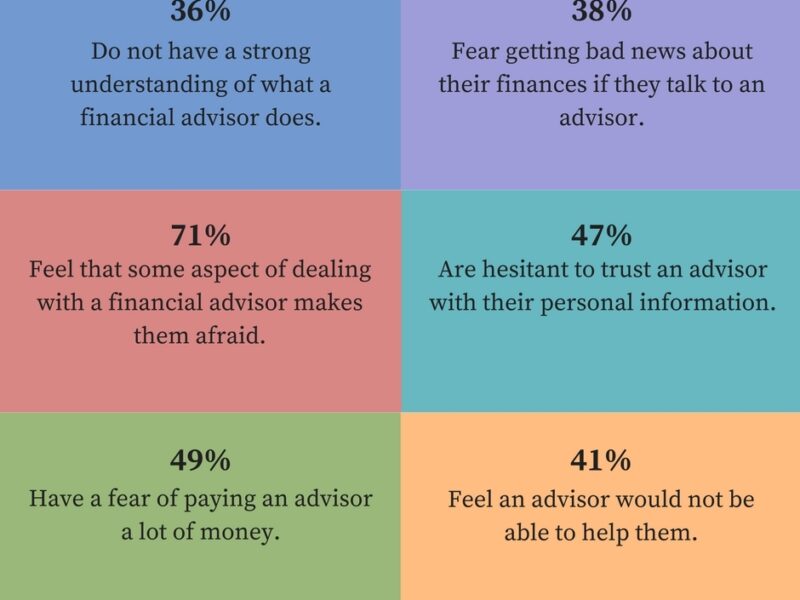

Despite the valuable services they provide, financial planners are sometimes misunderstood. Let’s address some common misconceptions about financial planners and set the record straight.

- Financial Planners are Only for the Wealthy: This is a common misconception that prevents many people from seeking the guidance of a financial planner. Financial planners work with individuals at various income levels and can provide guidance regardless of your financial situation. Whether you’re just starting out or planning for retirement, a financial planner can help you make the most of your money.

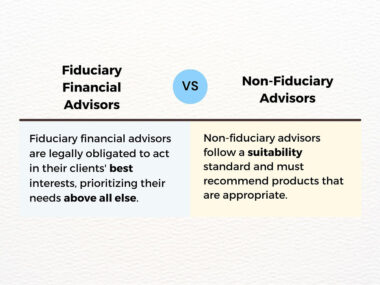

- Financial Planners are Just Salespeople: While there may be some individuals who prioritize selling financial products over providing holistic financial advice, reputable financial planners focus on your overall financial well-being. Their goal is to help you achieve your financial goals, not push products that may not be in your best interest. It’s important to choose a financial planner who acts as a fiduciary, meaning they have a legal obligation to act in your best interest.

- Financial Planners Only Manage Investments: While investment management is an important aspect of financial planning, it is not the only focus. Financial planners take a comprehensive approach, considering all aspects of your financial life, including budgeting, debt management, tax planning, and retirement planning. They create a holistic financial plan that addresses your unique needs and goals.

How to Choose the Right Financial Planner for Your Needs

Choosing the right financial planner is crucial to ensure a successful partnership. Here are some factors to consider when selecting a financial planner that aligns with your needs.

- Credentials and Qualifications: Look for financial planners who hold relevant certifications, such as the Certified Financial Planner (CFP) designation. These credentials demonstrate a commitment to professional standards and ongoing education.

- Experience and Expertise: Consider the experience and expertise of the financial planner. How long have they been in the industry? Do they have experience working with clients in similar circumstances to yours? Look for someone who has a track record of successfully helping clients achieve their financial goals.

- Fee Structure: Financial planners can be compensated in various ways, including fees, commissions, or a combination of both. It’s important to understand how they are compensated and evaluate whether their fee structure aligns with your preferences and financial situation.

- Communication and Personal Chemistry: Building a strong rapport with your financial planner is essential. Look for someone who communicates clearly, listens attentively, and understands your unique needs. The relationship with your financial planner should be built on trust and open communication.

- Client Reviews and References: Take the time to research and read client reviews or testimonials. This can provide valuable insights into the experiences of previous and current clients. Additionally, consider asking for references and reaching out to individuals who have worked with the financial planner to get a firsthand perspective.

The Importance of Ongoing Financial Planning

Financial planning is not a one-time event; it’s an ongoing process. As your life circumstances change and the financial landscape evolves, it’s important to revisit and adjust your financial plan. Here’s why ongoing financial planning is crucial.

- Change is Inevitable: Life is unpredictable, and your financial needs will likely change over time. Whether it’s starting a family, changing careers, or planning for retirement, your financial plan needs to adapt to these changes. Regularly reviewing and updating your plan ensures that it remains relevant and aligned with your goals.

- Maximizing Opportunities: The financial landscape is constantly evolving, with new investment opportunities, tax regulations, and financial products emerging. Ongoing financial planning allows you to stay informed about these opportunities and take advantage of them. By staying proactive, you can optimize your finances and make the most of market conditions.

- Peace of Mind: Knowing that you have a solid financial plan in place gives you peace of mind. It provides a sense of security and confidence, knowing that you are on track to achieve your financial goals. Regular check-ins with your financial planner can help alleviate any concerns or uncertainties you may have.

Frequently Asked Questions About Financial Planning

- Can I do my own financial planning? While it’s possible to manage your finances on your own, a financial planner provides expertise, guidance, and a comprehensive approach to financial planning. They have the knowledge and experience to help you navigate complex financial decisions and optimize your financial outcomes.

- How much does a financial planner cost? The cost of hiring a financial planner can vary depending on factors such as their experience, qualifications, and the complexity of your financial situation. Some financial planners charge a flat fee, while others may charge a percentage of the assets they manage. It’s important to discuss and understand the fee structure before engaging their services.

- When should I start working with a financial planner? It’s never too early or too late to start working with a financial planner. Whether you’re just starting your career or approaching retirement, a financial planner can help you make the most of your financial resources and guide you towards your goals.

- How often should I meet with my financial planner? The frequency of meetings with your financial planner will depend on your individual needs and circumstances. In the beginning, you may need more frequent meetings to establish your financial plan and make necessary adjustments. Once your plan is in place, regular check-ins, typically annually or semi-annually, can help ensure you stay on track.

Conclusion

In conclusion, a financial planner plays a crucial role in helping individuals and families navigate their financial goals. They provide expertise, guidance, and personalized financial plans to help you achieve your aspirations. By leveraging their knowledge and experience, you can make informed decisions about your money and take control of your financial future. So if you’re feeling overwhelmed or uncertain about your financial situation, consider consulting a financial planner to gain clarity and confidence in your financial decisions.