What is a fiduciary financial advisor?

A fiduciary financial advisor is a professional who is legally bound to act in the best interest of their clients. Unlike other types of financial advisors, fiduciaries prioritize their clients’ financial well-being over their own. This means that they are obligated to provide unbiased advice and make recommendations that align with their clients’ unique financial goals.

When you work with a fiduciary financial advisor, you can trust that they have your best interests at heart. They are committed to transparency and objectivity in their recommendations, ensuring that there are no conflicts of interest that could compromise the advice they provide. This level of trust and commitment sets fiduciary advisors apart in the financial industry.

Fiduciary financial advisors are typically held to a higher standard of care compared to other advisors. They are required to act prudently and diligently when managing their clients’ investments and financial affairs. This means that they must thoroughly analyze investment options, consider potential risks, and make informed decisions that are in the best interest of their clients.

Working with a fiduciary financial advisor can provide you with peace of mind knowing that your financial future is in capable hands. They are dedicated to helping you achieve your financial goals and will provide personalized advice and guidance tailored to your individual circumstances.

The importance of working with a fiduciary financial advisor

Choosing a financial advisor is a crucial decision that can have a significant impact on your financial future. It’s important to work with someone who has your best interests at heart and is committed to helping you achieve your financial goals. This is where a fiduciary financial advisor comes in.

One of the key benefits of working with a fiduciary advisor is the assurance that they are legally obligated to act in your best interest. This means that they must put your needs ahead of their own and provide advice that is free from conflicts of interest. This level of transparency and objectivity ensures that the advice you receive is tailored to your specific financial goals and circumstances.

Another important aspect of working with a fiduciary financial advisor is the peace of mind it provides. Knowing that your advisor is bound by a fiduciary duty to act in your best interest can alleviate concerns about potential hidden agendas or ulterior motives. This allows you to trust the advice and recommendations you receive, giving you confidence in your financial decisions.

Additionally, fiduciary financial advisors often have extensive experience and expertise in their field. They are well-versed in the complexities of financial planning, investment management, and other aspects of personal finance. This knowledge, combined with their commitment to acting in your best interest, allows them to provide valuable insights and guidance that can help you make informed decisions and achieve your financial goals.

Overall, working with a fiduciary financial advisor is important because it ensures that your advisor is truly on your side. They are dedicated to helping you succeed and will go above and beyond to provide the guidance and support you need. By choosing a fiduciary advisor, you can have confidence that your financial future is in capable hands.

How a fiduciary financial advisor differs from other types of financial advisors

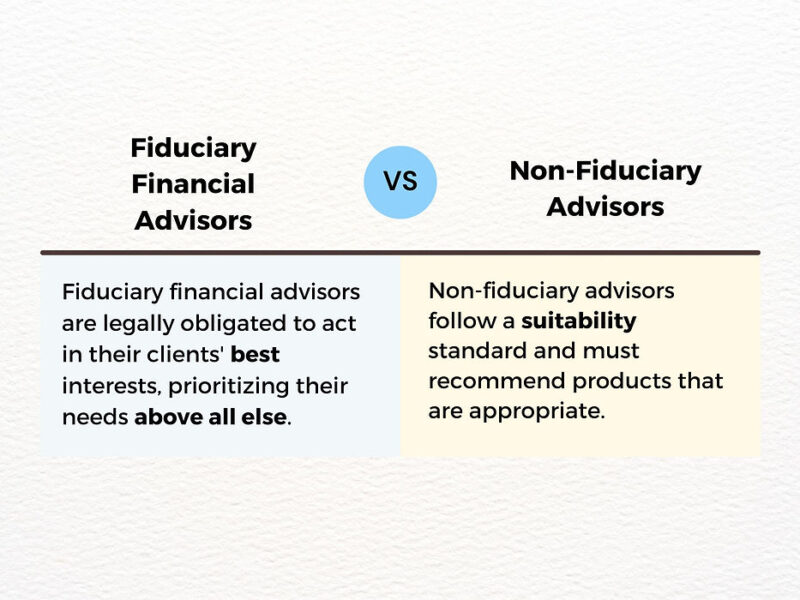

While there are various types of financial advisors available, not all of them operate under the fiduciary standard. Understanding the differences between a fiduciary financial advisor and other types of advisors can help you make an informed decision when choosing the right professional to manage your finances.

One key distinction is the legal obligation to act in the best interest of their clients. Fiduciary financial advisors are bound by a fiduciary duty, which means they must prioritize their clients’ best interests above their own. This duty ensures that they provide unbiased advice and make recommendations that are solely focused on helping their clients achieve their financial goals.

On the other hand, non-fiduciary financial advisors may operate under a suitability standard. This means that they are only required to recommend products or services that are suitable for their clients’ needs, but not necessarily in their best interest. This distinction can create conflicts of interest, as non-fiduciary advisors may be incentivized to recommend products or services that benefit them financially, rather than their clients.

Another difference lies in the compensation structure. Fiduciary financial advisors typically charge a fee for their services, which is often based on a percentage of the assets they manage or a flat fee. This fee structure is transparent and eliminates potential conflicts of interest that can arise from commissions or sales-based compensation.

Non-fiduciary financial advisors, on the other hand, may earn commissions or other forms of compensation from the products or services they recommend. This can create a conflict of interest, as their recommendations may be influenced by the potential financial gain they stand to receive.

Ultimately, the key difference between a fiduciary financial advisor and other types of advisors lies in the level of trust and transparency they provide. By choosing a fiduciary advisor, you can have confidence that their recommendations are solely focused on your best interest, providing you with a solid foundation for financial success.

The fiduciary duty and client-centered approach

The fiduciary duty is a legal obligation that fiduciary financial advisors have to act in the best interest of their clients. This duty is the cornerstone of their client-centered approach and sets them apart from other types of financial advisors.

The fiduciary duty requires fiduciary financial advisors to prioritize their clients’ needs and goals above their own. This means that they must provide advice that is unbiased and solely focused on helping their clients achieve their financial objectives.

To fulfill their fiduciary duty, fiduciary financial advisors must act with prudence, diligence, and care when managing their clients’ investments and financial affairs. This includes thoroughly analyzing investment options, considering potential risks, and making informed decisions that are in the best interest of their clients.

Transparency is also a key component of the fiduciary duty. Fiduciary financial advisors are required to disclose any conflicts of interest that may arise and ensure that their clients have a clear understanding of the fees, costs, and potential risks associated with their recommendations. This transparency allows clients to make informed decisions and have confidence in the advice they receive.

The fiduciary duty also extends beyond the initial recommendations. Fiduciary financial advisors have an ongoing obligation to monitor their clients’ investments and financial situation, making adjustments as necessary to ensure they remain aligned with their clients’ goals. This continuous monitoring and proactive approach help clients stay on track and adapt to changing circumstances.

Overall, the fiduciary duty and client-centered approach of fiduciary financial advisors ensure that their clients’ best interests are always the top priority. By choosing a fiduciary advisor, you can have confidence that your financial future is in capable hands.

Choosing a fiduciary financial advisor – factors to consider

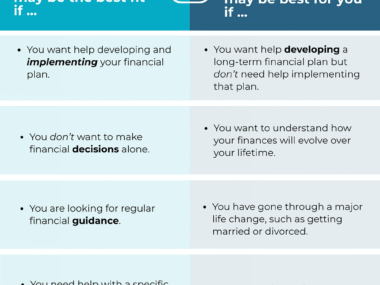

When choosing a fiduciary financial advisor, there are several factors to consider to ensure you find the right professional to meet your needs. Taking the time to evaluate these factors can help you make an informed decision and establish a successful partnership.

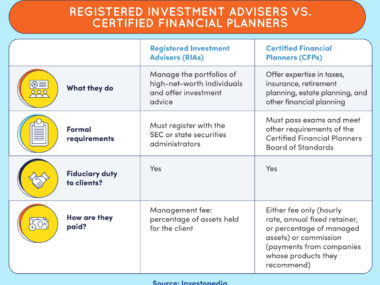

First and foremost, it’s important to consider the advisor’s qualifications and experience. Look for certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), as these designations demonstrate a high level of expertise and commitment to professional standards. Additionally, consider the advisor’s experience in working with clients who have similar financial goals or circumstances to yours.

Next, consider the advisor’s areas of specialization. Financial planning encompasses a wide range of topics, including retirement planning, investment management, tax planning, estate planning, and more. Ensure that the advisor you choose has expertise in the specific areas that are most relevant to your needs.

Another important factor to consider is the advisor’s communication style and approach. Building a strong working relationship with your advisor is crucial for a successful partnership. Consider whether their communication style aligns with your preferences and whether they take the time to understand your goals and concerns.

Fees and compensation structure are also important considerations. Fiduciary financial advisors typically charge a fee for their services, which can vary depending on the advisor and the complexity of your financial situation. Ensure that you have a clear understanding of the fees and costs involved before committing to a relationship.

Lastly, consider the advisor’s approach to financial planning and investment management. Some advisors may take a passive approach, focusing on long-term investment strategies and diversification, while others may take a more active approach, seeking to capitalize on short-term market opportunities. Consider your risk tolerance and investment preferences to ensure that the advisor’s approach aligns with your goals.

By carefully evaluating these factors and conducting thorough research, you can find a fiduciary financial advisor who is the right fit for your financial needs and goals. Remember, choosing the right advisor is a crucial step in achieving financial success.

Common questions about working with a fiduciary financial advisor

Working with a fiduciary financial advisor can provide numerous benefits and help you achieve your financial goals. However, you may have some questions about the process and what to expect. Here are some common questions and answers to help you understand what working with a fiduciary advisor entails.

- What does it mean to work with a fiduciary financial advisor?

Working with a fiduciary financial advisor means that you are partnering with a professional who is legally obligated to act in your best interest. They prioritize your financial well-being over their own and provide unbiased advice that is tailored to your specific goals and circumstances.

- How can a fiduciary financial advisor help me?

A fiduciary financial advisor can help you in various aspects of your financial life. They can assist with retirement planning, investment management, tax planning, estate planning, and more. Their expertise and commitment to acting in your best interest ensure that you receive personalized advice and guidance that aligns with your goals.

- How do fiduciary financial advisors get paid?

Fiduciary financial advisors typically charge a fee for their services. This fee structure is often based on a percentage of the assets they manage or a flat fee. This transparent compensation structure eliminates potential conflicts of interest that can arise from commissions or sales-based compensation.

- How do I find a trustworthy fiduciary financial advisor?

Finding a trustworthy fiduciary financial advisor involves conducting thorough research and evaluating various factors. Consider their qualifications, experience, areas of specialization, communication style, and approach to financial planning and investment management. Additionally, seek recommendations from trusted sources and consider reading client testimonials or reviews.

- Can I trust that my fiduciary financial advisor will act in my best interest?

Yes, you can trust that your fiduciary financial advisor will act in your best interest. Their fiduciary duty legally binds them to prioritize your needs and goals above their own. This ensures transparency, objectivity, and a client-centered approach in their recommendations.

- How often will I meet with my fiduciary financial advisor?

The frequency of meetings with your fiduciary financial advisor can vary depending on your needs and preferences. Initially, you may have more frequent meetings to establish a financial plan and set goals. After that, meetings may be scheduled on a quarterly, semi-annual, or annual basis to review progress, make adjustments, and address any questions or concerns.

By working with a fiduciary financial advisor, you can have confidence that your best interests are always the top priority. They are dedicated to helping you achieve your financial goals and will provide the guidance and support you need along the way.

Benefits of hiring a fiduciary financial advisor

Hiring a fiduciary financial advisor can provide numerous benefits and help you achieve your financial goals. Here are some key advantages of working with a fiduciary advisor:

- Unbiased advice: Fiduciary financial advisors are legally obligated to act in your best interest. This means that they provide unbiased advice that is solely focused on helping you achieve your financial goals. Their recommendations are free from conflicts of interest, ensuring transparency and objectivity.

- Tailored guidance: Fiduciary financial advisors take the time to understand your unique financial goals, circumstances, and risk tolerance. They provide personalized guidance and recommendations that are tailored to your specific needs. This ensures that the advice you receive is relevant and aligned with your goals.

- Expertise and experience: Fiduciary financial advisors often have extensive experience and expertise in their field. They stay up-to-date with the latest industry trends, regulations, and investment strategies. This knowledge allows them to provide valuable insights and guidance that can help you make informed decisions.

- Financial planning: Fiduciary financial advisors can assist with various aspects of financial planning, including retirement planning, investment management, tax planning, estate planning, and more. They help you create a comprehensive financial plan that takes into account your short-term and long-term goals.

- Ongoing support: Fiduciary financial advisors provide ongoing support and monitoring of your financial situation. They review your investments regularly, make adjustments as necessary, and keep you informed about any changes that may impact your financial plan. This proactive approach helps you stay on track and adapt to changing circumstances.

- Peace of mind: Working with a fiduciary financial advisor provides peace of mind knowing that your financial future is in capable hands. You can trust that your advisor has your best interests at heart and is committed to helping you achieve your goals. This allows you to focus on other aspects of your life, knowing that your finances are being managed professionally.

Overall, hiring a fiduciary financial advisor can provide you with the guidance, expertise, and peace of mind needed to achieve your financial goals. They act as a trusted partner, helping you navigate the complexities of personal finance and make informed decisions.

Fiduciary financial advisor vs. non-fiduciary financial advisor – key differences

Understanding the differences between a fiduciary financial advisor and a non-fiduciary financial advisor can help you make an informed decision when choosing the right professional to manage your finances. Here are some key distinctions between the two:

- Legal obligation: Fiduciary financial advisors are legally bound to act in your best interest. They prioritize your needs and goals above their own and provide unbiased advice. Non-fiduciary financial advisors may operate under a suitability standard, which means they are only required to recommend products or services that are suitable for your needs, but not necessarily in your best interest.

- Transparency: Fiduciary financial advisors are committed to transparency in their recommendations and compensation structure. They are required to disclose any conflicts of interest and ensure that you have a clear understanding of the fees, costs, and potential risks associated with their services. Non-fiduciary financial advisors may earn commissions or other forms of compensation from the products or services they recommend, creating