What Is Bridging Finance

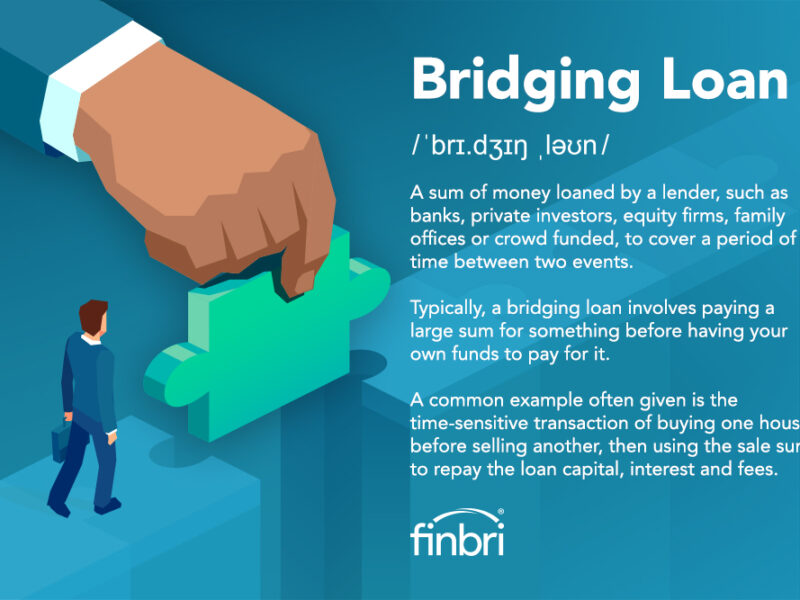

Are you in need of quick and flexible funding for your property purchase? Look no further than bridging finance. Bridging finance is a short-term loan specifically designed to bridge the gap between a debt becoming due and the main line of credit becoming available. It provides immediate access to funds, allowing individuals and businesses to complete property transactions more efficiently.

With bridging finance, you don’t have to wait for the lengthy approval process of traditional bank loans. This type of financing is ideal for those who need funds urgently, such as property investors or homebuyers facing tight deadlines. Whether you’re buying a new property, refurbishing an existing one, or even buying at auction, bridging finance offers the flexibility and speed you need to move quickly.

How does bridging finance work?

Bridging finance works by providing short-term funding to bridge the gap between the purchase of a property and the long-term financing solution becoming available. When you apply for bridging finance, the lender will assess the value of the property being used as security, along with your ability to repay the loan. Once approved, you will receive the funds, which can be used for a variety of purposes related to property transactions.

The loan term for bridging finance is typically short, ranging from a few weeks to a few months, depending on your specific needs. During this period, you will be required to make interest-only payments, with the full loan amount due at the end of the term. This allows you to focus on your property transaction without the added pressure of immediate principal repayments.

It’s important to note that bridging finance is a secured loan, meaning you will need to provide collateral, such as the property you’re purchasing or an existing property you own. The value of the collateral will determine the loan amount you can qualify for. In the event that you’re unable to repay the loan, the lender has the right to sell the property to recover their funds.

Types of bridging finance

There are two main types of bridging finance: open and closed bridging finance. Open bridging finance is suitable for borrowers who have a definite repayment date in mind but are waiting for funds to become available. This type of bridging finance allows flexibility in the repayment period, giving borrowers more time to secure long-term financing.

Closed bridging finance, on the other hand, is suitable for borrowers who have a fixed repayment date in place, such as the sale of an existing property. With closed bridging finance, the repayment date is predetermined, providing certainty for both the borrower and the lender. This type of bridging finance is often used when the borrower has exchanged contracts on the sale of their existing property but has not yet completed the transaction.

When to consider bridging finance

Bridging finance can be a useful tool in a variety of situations. Here are some scenarios where bridging finance may be worth considering:

Property purchase: If you’ve found your dream property but haven’t sold your current one yet, bridging finance can provide the funds needed to secure the new property while you wait for the sale to go through.

Auction purchases: When buying at auction, you typically need to pay a deposit immediately and settle the full amount within a short timeframe. Bridging finance can give you the necessary funds to secure the property at auction and then arrange suitable long-term financing later.

Property development: If you’re planning to undertake a property development project, bridging finance can provide the necessary funds for purchasing the property and covering renovation costs. Once the project is completed, you can refinance with a traditional loan.

Chain breaks: If you’re part of a property chain and the sale of one property falls through, bridging finance can prevent the collapse of the entire chain by providing the funds needed to keep the purchase process moving forward.

Benefits of bridging finance

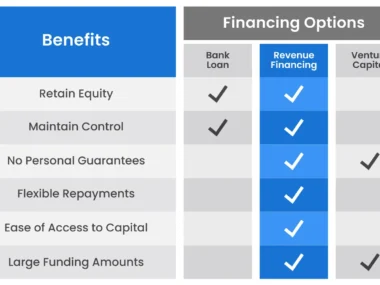

While bridging finance may come with higher interest rates and fees compared to traditional loans, it offers numerous benefits that make it an attractive option for many borrowers. Here are some key benefits of bridging finance:

Quick access to funds: Bridging finance can provide immediate access to funds, allowing you to take advantage of time-sensitive opportunities in the property market. This is especially beneficial when speed is essential, such as buying at auction or securing a property before someone else does.

Flexible repayment options: With bridging finance, you have the flexibility to choose interest-only repayments during the loan term. This can help ease your financial burden while you’re in the process of finalizing long-term financing or awaiting the sale of an existing property.

Ability to secure properties: Bridging finance gives you the ability to secure properties that may otherwise slip through your fingers. It allows you to act quickly and confidently when competing against other buyers, ensuring you don’t miss out on lucrative opportunities.

Bridge financial gaps: Bridging finance can bridge the financial gap between property transactions, whether it’s due to a delayed sale or a timing mismatch between purchase and long-term financing. It provides the necessary funds to keep your property plans on track.

Versatility in use: Bridging finance can be used for a range of purposes, including property purchases, refurbishments, renovations, and even land acquisition. This versatility makes it a popular choice among property investors and developers.

Bridging finance vs. traditional loans

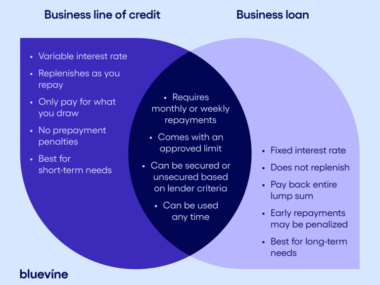

When comparing bridging finance to traditional loans, there are several key differences to consider. Traditional loans, such as mortgages, typically have longer approval processes and stricter eligibility criteria. Bridging finance, on the other hand, offers a faster approval process and more lenient eligibility requirements, making it an attractive option for those who need funds urgently.

Traditional loans also often require a more extensive documentation process, including proof of income, tax returns, and credit checks. Bridging finance lenders may be more flexible in their requirements, focusing more on the value of the property being used as collateral and your ability to repay the loan.

Another difference between bridging finance and traditional loans is the loan term. Traditional loans typically have longer loan terms, ranging from several years to several decades, while bridging finance has a shorter loan term, usually ranging from a few weeks to a few months.

How to apply for bridging finance

Applying for bridging finance is a straightforward process. Here are the general steps involved:

Research lenders: Start by researching different bridging finance providers and lenders to find the best fit for your needs. Consider factors such as interest rates, fees, loan terms, and customer reviews.

Gather documentation: Prepare the necessary documentation, which may include identification documents, proof of income, bank statements, and property-related documents. Each lender may have specific requirements, so it’s important to check their documentation checklist.

Get a valuation: The lender will require a valuation of the property being used as collateral. This can be conducted by an independent valuer appointed by the lender or by a valuer of your choice, subject to the lender’s approval.

Submit your application: Complete the application form provided by the lender and submit it along with the required documentation. Make sure to provide accurate and detailed information to expedite the approval process.

Receive an offer: If your application is successful, you will receive a formal offer outlining the terms and conditions of the bridging finance. Review the offer carefully and seek legal advice if necessary.

Accept the offer: If you’re satisfied with the terms and conditions, accept the offer by signing the necessary documents and returning them to the lender.

Receive funds: Once all the documentation has been processed and the necessary checks have been completed, the lender will disburse the funds to you or directly to the relevant parties involved in the property transaction.

Bridging finance providers and lenders

There are numerous bridging finance providers and lenders in the market. Some specialize in specific types of bridging finance, such as residential or commercial, while others cater to a broader range of borrowers. Here are a few reputable bridging finance providers to consider:

ABC Bridging Finance: ABC Bridging Finance is a leading provider of short-term finance solutions for property transactions. They offer flexible bridging finance options with competitive interest rates and fast approval processes.

XYZ Bridging: XYZ Bridging is known for its expertise in bridging finance for property developers and investors. They offer tailored solutions to meet the unique needs of each borrower, providing quick access to funds for property-related projects.

BridgeFinance Ltd: BridgeFinance Ltd is a trusted bridging finance lender with a strong track record in the industry. They offer a range of bridging finance options, including open and closed bridging finance, to suit different borrower requirements.

It’s important to research and compare different bridging finance providers and lenders to find the best fit for your specific needs. Consider factors such as interest rates, fees, loan terms, and customer reviews to make an informed decision.

Case studies of successful bridging finance deals

To illustrate the effectiveness of bridging finance, let’s take a look at a couple of case studies showcasing successful bridging finance deals:

Case Study 1: Property Purchase

Situation: John found his dream property but hadn’t sold his current home yet. He needed funds quickly to secure the new property before someone else did.

Solution: John applied for bridging finance and was approved within a short period. He used the funds to purchase the new property and paid interest-only repayments during the bridging loan term.

Outcome: John successfully secured the new property and was able to complete the purchase. Once he sold his existing property, he repaid the bridging loan in full.

Case Study 2: Property Development

Situation: Sarah planned to renovate an old property and turn it into a profitable rental property. She needed funds to purchase the property and cover renovation costs.

Solution: Sarah applied for bridging finance and was approved based on the value of the property and her ability to repay the loan. She used the funds to purchase the property and complete the renovations.

Outcome: Sarah successfully completed the property development project and refinanced with a traditional loan once the property was tenanted. The rental income generated covered the ongoing loan repayments.

These case studies highlight how bridging finance can provide the necessary funds and flexibility to achieve property-related goals.

Conclusion and final thoughts

Bridging finance offers a valuable solution for those in need of quick and flexible funding for property transactions. Whether you’re buying a new property, refurbishing an existing one, or buying at auction, bridging finance provides immediate access to funds, allowing you to move quickly and efficiently.

While bridging finance may come with higher interest rates and fees compared to traditional loans, it offers numerous benefits, including quick access to funds, flexible repayment options, and the ability to secure properties that may otherwise slip through your fingers.

When considering bridging finance, it’s important to research different providers and lenders to find the best fit for your specific needs. Compare interest rates, fees, loan terms, and customer reviews to make an informed decision.

Ultimately, bridging finance can be a powerful tool in your property investment arsenal, enabling you to take advantage of time-sensitive opportunities and achieve your property-related goals with confidence. So, if you require immediate financial assistance for your property transactions, consider bridging finance as a viable solution.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. It is recommended to consult with a qualified financial advisor before making any financial decisions.