Yahoo Stock Screener: The Ultimate Tool for Smart Investing

Looking to invest in the stock market? Look no further than the Yahoo Stock Screener. This powerful tool allows you to filter through thousands of stocks based on your desired criteria, giving you the ability to make informed investment decisions. Whether you’re a seasoned investor or just starting out, the Yahoo Stock Screener provides a user-friendly interface that makes it easy to find the right stocks for your portfolio.

Understanding the purpose of a stock screener

In the world of stock market investing, information is key. With thousands of stocks listed on various exchanges, it can be overwhelming to manually analyze each one to find the best investment opportunities. That’s where a stock screener comes in handy. A stock screener is a tool that allows you to filter stocks based on specific criteria, helping you narrow down your options and focus on the stocks that meet your investment objectives.

The Yahoo Stock Screener is one of the most popular stock screeners available, offering a wide range of features and customization options. Whether you’re looking for large-cap stocks with high dividend yields or small-cap stocks with low price-earnings ratios, the Yahoo Stock Screener has got you covered.

Key features of the Yahoo Stock Screener

The Yahoo Stock Screener offers a plethora of features that make it a go-to tool for investors of all levels. Here are some key features that set it apart from other stock screeners:

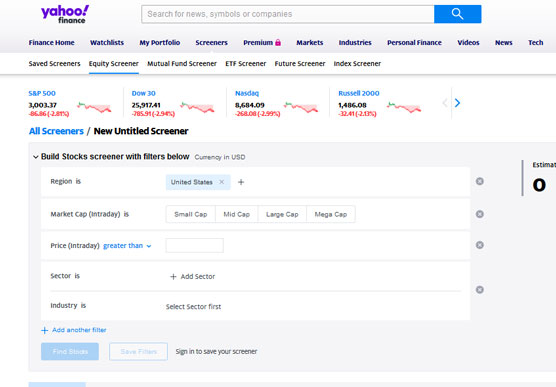

- Easy-to-use interface: The Yahoo Stock Screener provides a user-friendly interface that makes it easy to navigate and customize your search criteria. With just a few clicks, you can set up filters based on your preferred stock attributes.

- Wide range of search criteria: The Yahoo Stock Screener allows you to filter stocks based on various factors, including market capitalization, price-earnings ratio, dividend yield, and more. You can also customize your search by sector, industry, and country, giving you the flexibility to find stocks that align with your investment strategy.

- Real-time data: The Yahoo Stock Screener pulls real-time data from the stock market, ensuring that you have access to the most up-to-date information. This is crucial for making informed investment decisions and staying ahead of market trends.

- Advanced options and filters: The Yahoo Stock Screener offers advanced options and filters that allow you to refine your search even further. You can set specific ranges for each criteria, such as minimum and maximum market capitalization, to narrow down the results to stocks that meet your exact requirements.

How to use the Yahoo Stock Screener effectively

Now that you’re familiar with the key features of the Yahoo Stock Screener, let’s dive into how you can use it effectively to find the best investment opportunities. Here’s a step-by-step guide to get you started:

- Define your investment goals: Before using the Yahoo Stock Screener, it’s important to have a clear understanding of your investment goals. Are you looking for high-growth stocks or stable dividend-paying stocks? Are you interested in a specific sector or industry? By defining your investment goals, you can set up filters that align with your objectives.

- Choose your search criteria: Once you’ve defined your investment goals, it’s time to choose the search criteria that will help you find the right stocks. The Yahoo Stock Screener offers a wide range of criteria, including market capitalization, price-earnings ratio, dividend yield, and more. Select the criteria that are most important to you and set specific ranges if desired.

- Customize your search: In addition to the basic search criteria, the Yahoo Stock Screener allows you to customize your search by sector, industry, and country. This is particularly useful if you have a specific preference or if you want to focus on a particular market. Customize your search to narrow down the results and find stocks that match your investment strategy.

- Analyze the results: Once you’ve set up your search criteria and customized your search, the Yahoo Stock Screener will generate a list of stocks that meet your requirements. Take the time to analyze the results and dig deeper into the fundamentals of each stock. Look at key financial metrics, such as revenue growth, earnings per share, and debt levels, to get a better understanding of the company’s financial health.

- Monitor and track your investments: Investing is an ongoing process, and it’s important to monitor and track your investments regularly. The Yahoo Stock Screener allows you to save your search criteria and set up alerts, so you can stay updated on any changes that may affect your portfolio. Use this feature to your advantage and make adjustments to your investment strategy as needed.

Customizing your stock screening criteria

One of the key advantages of the Yahoo Stock Screener is its ability to customize your stock screening criteria. By tailoring the search to your specific preferences, you can find stocks that align with your investment strategy and risk tolerance. Here are some tips for customizing your stock screening criteria:

- Focus on key financial metrics: Start by focusing on key financial metrics that are important to you. This could include revenue growth, earnings per share, or debt levels. By setting specific ranges for these metrics, you can filter out stocks that don’t meet your requirements.

- Consider sector and industry: If you have a preference for a specific sector or industry, make sure to include it in your search criteria. The Yahoo Stock Screener allows you to filter stocks based on sector and industry, helping you narrow down the results to stocks that are relevant to your investment strategy.

- Set minimum and maximum values: In addition to specific ranges, you can also set minimum and maximum values for each criteria. For example, you may want to filter out stocks with a market capitalization below a certain threshold or stocks with a price-earnings ratio above a certain level. Use these options to fine-tune your search and find stocks that fit your investment criteria.

- Experiment with different combinations: Don’t be afraid to experiment with different combinations of criteria to see what works best for you. The Yahoo Stock Screener allows you to save multiple search criteria, so you can easily switch between different strategies and compare the results. Take advantage of this feature to refine your investment approach and find stocks that have the potential to outperform the market.

Advanced options and filters in the Yahoo Stock Screener

The Yahoo Stock Screener goes beyond basic search criteria and offers advanced options and filters that allow you to further refine your search. Here are some advanced options and filters that you can utilize to enhance your stock screening process:

- Customizable columns: The Yahoo Stock Screener allows you to customize the columns displayed in the search results. This means you can choose which metrics and data points are most important to you and view them at a glance. Customizable columns make it easier to compare stocks and make informed investment decisions.

- Sorting options: The Yahoo Stock Screener offers various sorting options, allowing you to sort stocks based on different criteria, such as market capitalization, dividend yield, or price-earnings ratio. Sorting options make it easier to identify stocks that meet your desired criteria and prioritize them in your investment strategy.

- Technical indicators: In addition to fundamental criteria, the Yahoo Stock Screener also offers a range of technical indicators that can help you analyze stocks from a technical perspective. These indicators include moving averages, relative strength index (RSI), and Bollinger Bands, among others. Incorporating technical indicators into your stock screening process can provide additional insights and help you make more informed investment decisions.

- Saved searches and alerts: The Yahoo Stock Screener allows you to save your search criteria and set up alerts, so you can stay updated on any changes that may affect your portfolio. Saved searches and alerts are particularly useful for monitoring stocks that are on your watchlist or for tracking specific sectors or industries. Take advantage of these features to streamline your stock screening process and stay ahead of market trends.

Analyzing the results from your stock screener search

Once you’ve generated a list of stocks that meet your criteria using the Yahoo Stock Screener, it’s time to analyze the results and dig deeper into the fundamentals of each stock. Here are some key factors to consider when analyzing the results:

- Financial health: Start by looking at the financial health of each company. Review key financial metrics, such as revenue growth, earnings per share, and debt levels, to get a better understanding of the company’s financial stability. Look for companies with consistent revenue and earnings growth and manageable debt levels.

- Competitive advantage: Consider the competitive advantage of each company. Does it have a unique product or service? Does it operate in a growing industry? Look for companies that have a sustainable competitive advantage, as this can be a strong indicator of long-term success.

- Industry trends: Assess the trends and dynamics of the industry in which each company operates. Is the industry growing or declining? Are there any regulatory or technological changes that could impact the industry? Understanding the industry landscape can help you evaluate the growth potential and future prospects of each company.

- Valuation: Finally, consider the valuation of each stock. Is it trading at a reasonable price relative to its earnings and growth prospects? Compare the stock’s price-earnings ratio to its peers and industry average to determine if it’s undervalued or overvalued. Remember that a low valuation alone does not necessarily make a stock a good investment if the fundamentals are weak.

Tips and tricks for using the Yahoo Stock Screener

To get the most out of the Yahoo Stock Screener, here are some tips and tricks to keep in mind:

- Start with broad criteria: When starting your search, it’s often helpful to begin with broad criteria and then gradually narrow down your options. This allows you to cast a wider net and explore different investment opportunities before refining your search further.

- Regularly update your search: The stock market is dynamic, and companies’ fundamentals can change over time. Make it a habit to regularly update your search criteria and review the results to ensure that you’re investing in stocks that still meet your requirements.

- Consider qualitative factors: While the Yahoo Stock Screener focuses on quantitative factors, don’t forget to consider qualitative factors as well. Look beyond the numbers and evaluate factors such as the company’s management team, brand reputation, and competitive position in the market.

- Diversify your portfolio: Investing in a diversified portfolio is important to manage risk and maximize returns. Use the Yahoo Stock Screener to identify stocks from different sectors and industries, and consider adding a mix of large-cap, mid-cap, and small-cap stocks to your portfolio.

Alternative stock screeners to consider

While the Yahoo Stock Screener is a powerful tool, it’s not the only option available. Here are some alternative stock screeners that you may want to consider:

- Finviz: Finviz offers a comprehensive stock screener with a wide range of search criteria and customizable filters. It provides real-time data and advanced charting tools, making it a popular choice among investors.

- StockFetcher: StockFetcher is a stock screener that focuses on technical analysis. It allows you to screen stocks based on various technical indicators and patterns, helping you find stocks with specific chart patterns or trading signals.

- Morningstar: Morningstar is a well-known investment research platform that offers a stock screener among its many tools. It provides a wide range of fundamental criteria and allows you to compare stocks side by side.

Conclusion and final thoughts on the Yahoo Stock Screener

The Yahoo Stock Screener is a valuable tool for investors looking to make informed investment decisions. With its user-friendly interface, wide range of search criteria, and advanced options and filters, it provides the flexibility and customization needed to find stocks that align with your investment strategy.

However, it’s important to remember that a stock screener is just a starting point. It’s not a substitute for thorough research and analysis. Use the Yahoo Stock Screener as a tool to identify potential investment opportunities, but always conduct your due diligence and evaluate the fundamentals of each stock before making any investment decisions.

So, if you’re ready to take your investment strategy to the next level, start using the Yahoo Stock Screener today. With its powerful features and comprehensive search capabilities, it’s sure to become an invaluable tool in your investing toolkit. Happy screening!

Learn More About Finance

Google Finance: Your Ultimate Resource for Financial Information